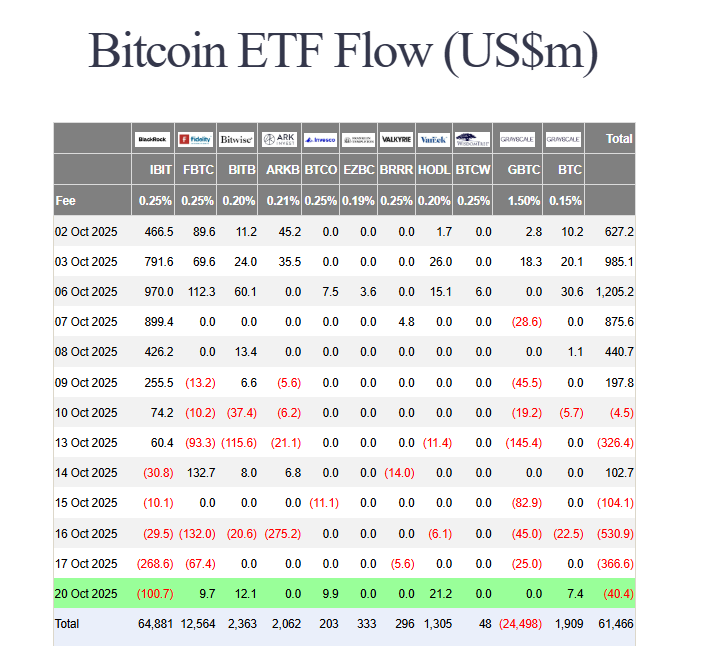

The streak of institutional withdrawals continues as Bitcoin ETF outflows extend into a fourth consecutive day. On October 20, spot Bitcoin ETFs saw another $40.46 million exit the funds, signaling a cautious pause in institutional buying despite Bitcoin’s recent recovery attempts.

Breaking Down the Bitcoin ETF Outflows

The data reveals a mixed picture beneath the surface. BlackRock’s iShares Bitcoin Trust (IBIT) led the Bitcoin ETF outflows, experiencing a single-day withdrawal of $101 million. This marked a notable shift for the ETF giant, which had previously been a steady source of inflows.

However, not all funds followed the same trend. VanEck’s HODL ETF and Bitwise’s BITB ETF actually saw modest inflows of $21.16 million and $12.05 million respectively. This divergence suggests that while some investors are taking profits, others are using the price dip as an entry point.

Despite the recent Bitcoin ETF outflows, the broader perspective remains impressive. The total net asset value of all spot Bitcoin ETFs still stands at a massive $149.66 billion, representing nearly 7% of Bitcoin’s entire market capitalization.

Key Takeaways

- Bitcoin ETF outflows continue for a fourth day, totaling $40.46M

- BlackRock’s IBIT saw $101M in outflows, the largest of the day

- VanEck and Bitwise funds saw modest inflows, showing divided sentiment

- Total ETF assets remain strong at $149.66B despite recent withdrawals

My Thoughts

This looks like healthy profit-taking rather than a loss of faith. After Bitcoin’s massive run-up, some institutional investors are naturally cashing in gains. The fact that total ETF assets remain near $150 billion shows the structural demand is still there. Once this period of consolidation ends and macroeconomic uncertainties clear, we could see inflows return with force.