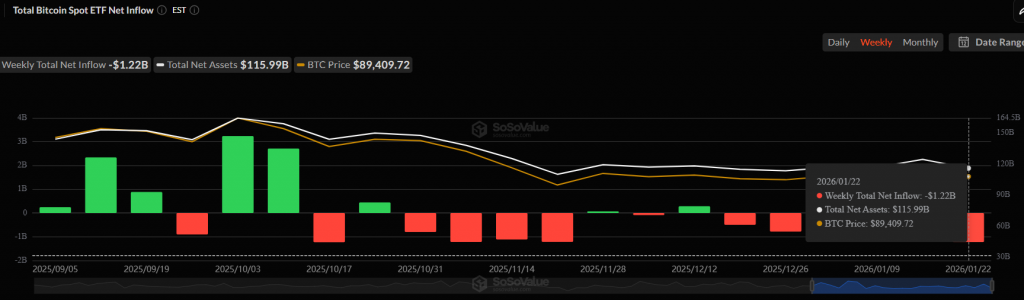

Institutional Retreat: Bitcoin ETF Outflows Spike to $1.22 Billion

The institutional mood has turned sharply negative. U.S. spot Bitcoin ETF outflows have accelerated dramatically, with a net $1.22 billion fleeing the products over just four days this week. This marks the largest weekly withdrawal in two months, clearly signaling that major investors are hitting pause after repeated failures to push Bitcoin convincingly above the $100,000 psychological barrier.

The scale of the exit is striking. Outflows peaked at $708.7 million on January 21, following a $479.7 million withdrawal the day prior. While the pace slowed to a trickle ($32M) by Wednesday, the damage was done. According to analysis from Ecoinometrics, this sell-off has disrupted a brief return of inflows, highlighting the “continued lack of sustained demand” needed for a robust BTC price recovery. The data is clear: institutional sentiment is cooling fast.

Will History Repeat? Analyzing Past Bitcoin ETF Outflows

Here’s the intriguing part for traders: heavy Bitcoin ETF outflows have often marked local price bottoms, not the start of prolonged bear markets. In November 2025, a similar four-day, $1.22 billion outflow aligned with Bitcoin bottoming near $80,000 before a swift rebound above $90,000. The same pattern played out in March 2025 ahead of tariff-related volatility.

Currently, the average cost basis for ETF investors sits at $84,099, a level that has repeatedly acted as a magnet for price during pullbacks. Crypto trader Ted Pillows notes that Bitcoin’s momentum has faded after a strong January start and highlights the $87,000-$87,500 zone as critical short-term support. A hold here could set the stage for a bounce.

My Thoughts

This is a classic “wall of worry” shakeout. The ETF flow data is ugly in the short term, but it’s likely flushing out weak institutional hands and setting up a stronger foundation. Remember, these are regulated outflows—transparent and measurable, unlike opaque OTC selling. The historical precedent is encouraging. For savvy investors, this period of fear, with BTC holding above the key $87K support, represents a high-conviction accumulation zone before the next institutional wave arrives.