Institutional Exodus: Bitcoin ETF Outflows Accelerate Ahead of $23B Showdown

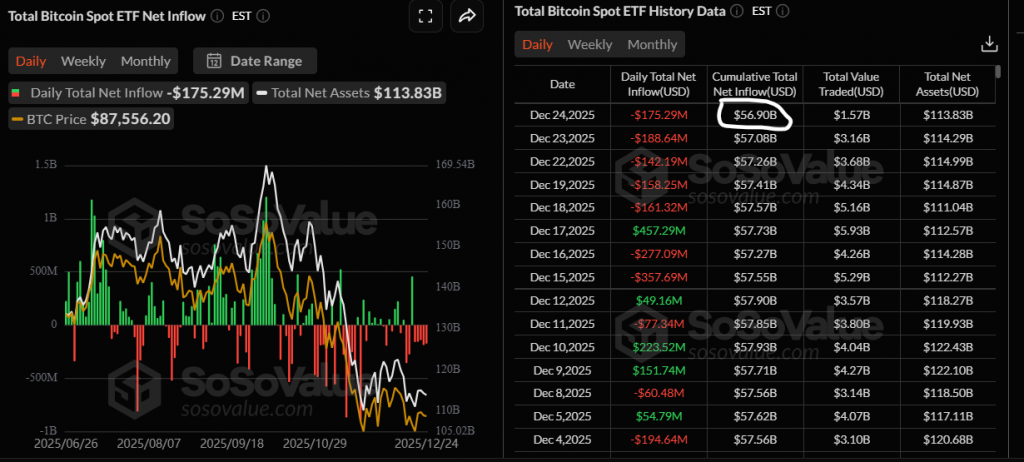

The institutional retreat from Bitcoin is gaining momentum. U.S. spot Bitcoin ETFs bled another $175 million on Wednesday, marking the fifth consecutive day of ETF outflows. This persistent selling, led by giants BlackRock and Fidelity, signals deepening caution as the market braces for a colossal $23 billion Bitcoin options expiry on Friday. With legendary traders issuing crash warnings, the stage is set for a high-stakes volatility event that could define the year’s end.

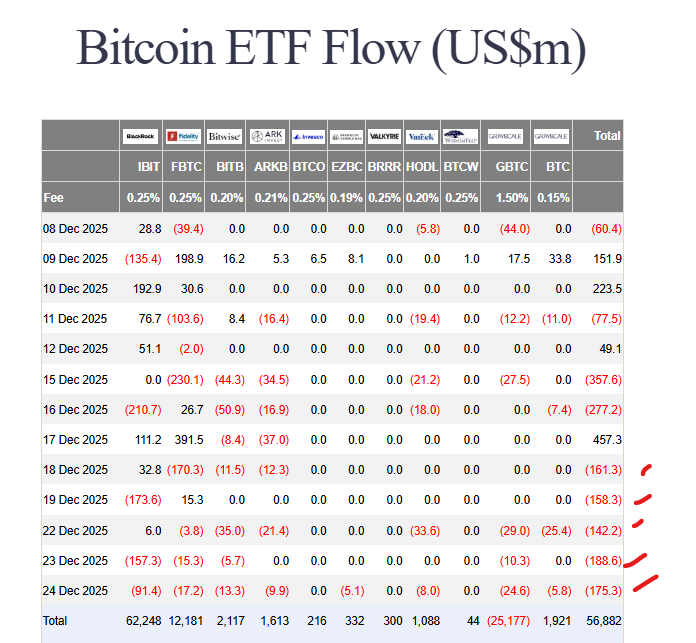

Decoding the Relentless ETF Outflows

The data reveals a clear and concerning trend. BlackRock’s IBIT fund led the exit with $91.4 million in outflows, contributing to a total cumulative inflow drop from $62.7 billion to $56.8 billion. This isn’t isolated profit-taking; it’s a coordinated institutional de-risking during thin holiday liquidity, often linked to tax-loss harvesting.

The timing is critical. This wave of ETF outflows culminates in Friday’s monumental options expiry on Deribit, where $23 billion in open interest will be decided. Such events often act as volatility catalysts, and the current bearish institutional sentiment adds a heavy layer of downward pressure.

Extreme Warnings: Analysts Forecast a Crash to $40K

Amidst the outflow streak, prominent analysts are issuing severe warnings. Veteran trader Peter Brandt and Fundstrat’s Tom Lee have warned of a drop to $60,000. More drastically, analyst Ali Martinez notes that breaks below the 50-week moving average have historically led to ~60% declines, projecting a potential bottom near $40,000 if history repeats.

These predictions are fueled by a “risk-off” macro backdrop, the Bank of Japan’s recent rate hike, and the sheer weight of unrealized losses among recent buyers. The combination of technical breakdowns and fleeing institutional capital creates a potent bearish cocktail.

The Bullish Counter-Argument: A Setup for a Massive Squeeze?

However, extreme fear can be a contrarian fuel. The massive options expiry has a “Max Pain” point that often pulls price, and the dominance of short positions could set up a violent squeeze if the market moves upward. The current ETF outflows and crash predictions are so pervasive that they arguably set the stage for a surprise rally, as markets frequently punish the consensus.

My Take

This is the definition of a tension-filled market. The ETF outflows are undeniably bearish in the short term, reflecting a tangible withdrawal of institutional support. However, I’m watching the options expiry closely. Such a large event often resets the board. If price holds above $85,000 through it, we could see a vicious short squeeze into year-end as the last bears capitulate. My plan? Wait for clarity post-expiry. A close below $85K opens the door to $80K, but a hold above it could spark a fierce counter-trend rally.