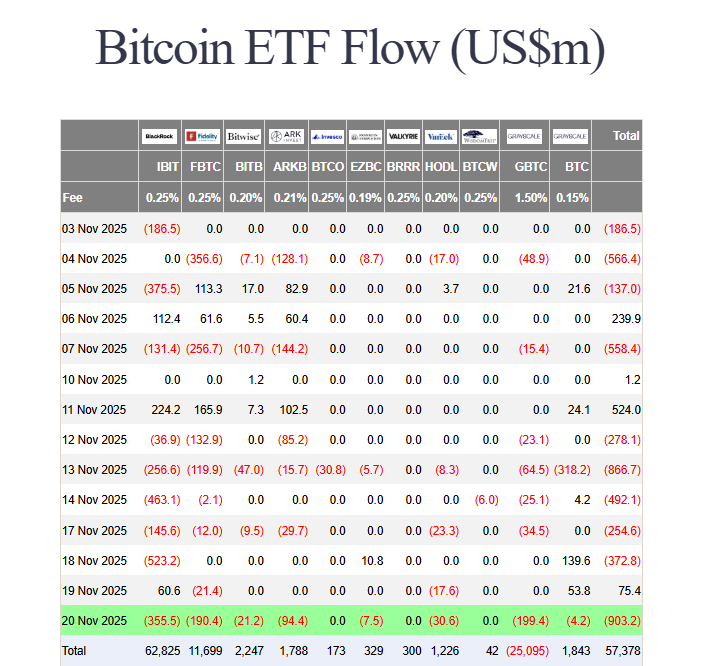

Bitcoin ETF Outflows Explode to $903M as Institutional Profit-Taking Intensifies

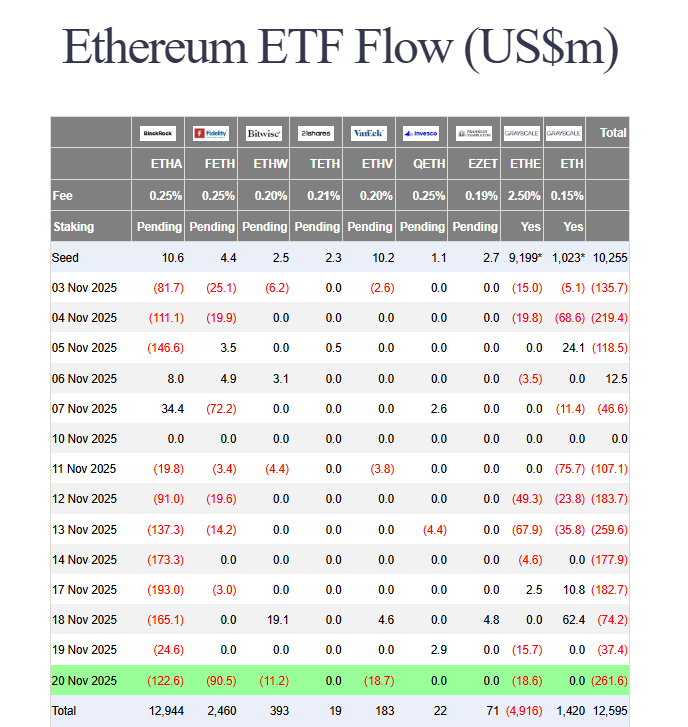

The floodgates have opened. U.S. Bitcoin spot ETFs just witnessed a devastating $903 million in net outflows, marking the second-largest single-day exodus since these funds launched in January. This massive institutional sell-off, led by BlackRock’s IBIT and Grayscale’s GBTC, slammed Bitcoin’s price and sent shockwaves through the entire crypto market. Simultaneously, Ethereum ETFs extended their brutal outflow streak to eight consecutive days, bleeding another $262 million. This is a clear signal that major players are hitting the sell button.

Institutions Drive the Sell-Off in Major Bitcoin ETF Outflows

The data paints an unambiguous picture: this is a coordinated institutional retreat. Analysts confirms these Bitcoin ETF outflows represent classic “risk-off positioning,” with large investors securing profits before the year-end. Rachael Lucas, a crypto analyst at BTC Markets, echoed this, stating, “Institutional investors are leading the charge, with ETF outflows signalling profit-taking.” This isn’t retail panic; this is smart money moving to the sidelines amid macroeconomic uncertainty and miner selling pressure.

A Contrarian Opportunity Emerges from the Carnage

However, within every crisis lies an opportunity. Przemysław Kral, CEO of zondacrypto, noted that while the Bitcoin ETF outflows indicate profit-taking, large Bitcoin holders (whales) are actively accumulating at these lower prices. He described this as a “sign of underlying strength and confidence.” This creates a fascinating divergence: institutions are selling the ETF product, while crypto-native whales are buying the underlying asset on-chain. For long-term investors, this volatility presents a chance to accumulate BTC at a significant discount from recent highs, though Kral wisely cautions that high volatility and a shifting macro landscape require careful risk management.

My Thoughts

This is a brutal but necessary flush. The Bitcoin ETF outflows are painful in the short term, but they are cleansing the market of weak institutional hands. The simultaneous whale accumulation is the ultimate bullish counter-signal. History shows that when ETFs see massive outflows and coins move from weak holders to strong ones, it often sets the stage for a powerful V-shaped recovery. The fear is palpable, but for those with a multi-year horizon, this is a gift.