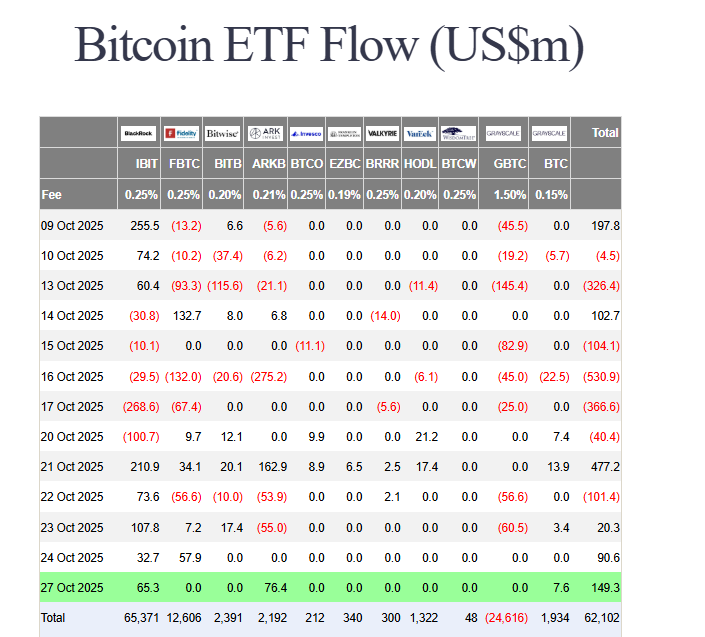

The stage is set for a potentially explosive week in crypto markets. Bitcoin ETFs kicked off Monday with a strong Bitcoin ETFs inflow of $149.3 million, signaling renewed institutional confidence as multiple major catalysts converge. This substantial capital arrival comes just as the Federal Reserve meets with a 96.7% probability of delivering a rate cut.

Bitcoin ETFs Inflow

The institutional buying was led by ARK Invest, which contributed $76.4 million, followed closely by BlackRock’s $65.3 million addition. This robust Bitcoin ETFs inflow demonstrates that smart money is positioning ahead of what could be a paradigm-shifting week for global risk assets.

Meanwhile, Bitcoin price is consolidating strategically around $114,490, building energy for a potential breakout. This technical coiling comes alongside the launch of multiple altcoin ETFs, including Solana, Litecoin, and Hedera funds, dramatically expanding the institutional product landscape.

The Perfect Macro Storm

Three seismic events are aligning simultaneously. First, the Fed’s expected rate cut would inject fresh liquidity into risk assets. Second, Thursday’s Trump-Xi meeting could de-escalate trade tensions that previously crushed markets. Third, the altcoin ETF wave represents the biggest expansion of crypto investment products since January.

This convergence is particularly powerful given October’s historical tendency to be “Uptober.” After initial weakness, Bitcoin has now flipped green for the month, maintaining its perfect October record and adding seasonal momentum to the technical setup.

Key Takeaways

- Strong

Bitcoin ETFs inflowof $149.3M led by ARK and BlackRock - Fed meeting with 96.7% probability of rate cut this week

- Trump-Xi trade talks Thursday could resolve major market overhang

- Multiple altcoin ETFs launching simultaneously

- Bitcoin consolidating at $114,490 ahead of potential breakout

My Thoughts

This is the most concentrated bullish catalyst cluster we’ve seen all year. When ETF inflows, Fed policy, geopolitical progress, and product expansion align like this, the conditions for a major leg up are undeniable. Bitcoin’s consolidation at these levels is actually bullish—it’s building energy rather than declining. If both the Fed and trade talks deliver positive outcomes, we could easily see a violent move toward $120,000+ this week.