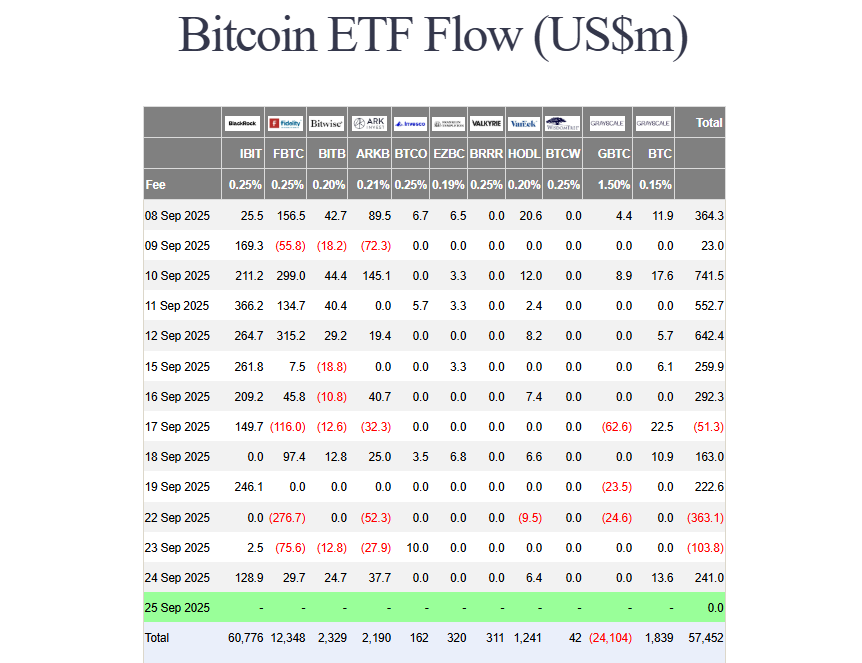

In a dramatic and powerful reversal, U.S. spot Bitcoin ETFs have shattered their negative trend. On September 24th, these funds exploded with a massive $241 million in net inflows. This stunning comeback ends several days of painful outflows, signaling a potential resurgence of bullish momentum.

A Closer Look at the Winning Funds

So, which funds led this incredible charge? The giants of the industry stepped up in a big way.

- BlackRock’s IBIT once again proved its dominance, pulling in a whopping $128.9 million.

- Ark Invest/21Shares’ ARKB followed with a strong $37.7 million inflow.

- Fidelity’s FBTC and Bitwise’s BITB contributed a combined $54.4 million.

Smaller but still significant inflows were seen in funds from VanEck and Franklin Templeton. This broad-based participation is a crucial sign of healthy, widespread demand.

What’s Driving the Sudden Optimism of Bitcoin ETFs?

This wave of Bitcoin ETFs inflows didn’t happen in a vacuum. It coincided with Bitcoin stabilizing between $111,000 and $113,000, buoyed by a more hopeful market mood. After recent volatility driven by Federal Reserve uncertainty, this influx suggests that investors are seeing current levels as a attractive entry point.

Bitcoin’s market cap stands at about $2.27 trillion, with 24-hour trading volume exceeding $48 billion. Prices fluctuate rapidly

Why This Reversal Matters for Your Portfolio

For investors, this isn’t just a one-day wonder. This explosive return of Bitcoin ETFs inflows could be a leading indicator. It shows that institutional money is quickly moving back into the market, often ahead of a major price move.

With total assets under management still towering above $100 billion, this surge is a powerful signal to watch. If this inflow trend continues, it could be the rocket fuel needed to launch the next leg of the Bitcoin bull run.