Investors poured a historic amount of money into BlackRock’s Bitcoin ETF as the cryptocurrency surged to new heights. The iShares Bitcoin ETF (IBIT) saw a staggering $788.3 million influx on Tuesday, marking its 37th consecutive day of gains. With this influx, the fund’s assets have now ballooned to $11.5 billion.

On the same day, Bitcoin briefly soared past $69,000, surpassing its previous all-time high from late 2021. The demand for ETFs and optimism surrounding a forthcoming reduction in Bitcoin’s supply growth have been driving recent gains. However, the coin has since dipped to around $67,000, likely due to profit-taking.

Emily Roland, co-chief investment strategist at John Hancock Investment Management, attributes the surge to a combination of FOMO, sentiment, and momentum.

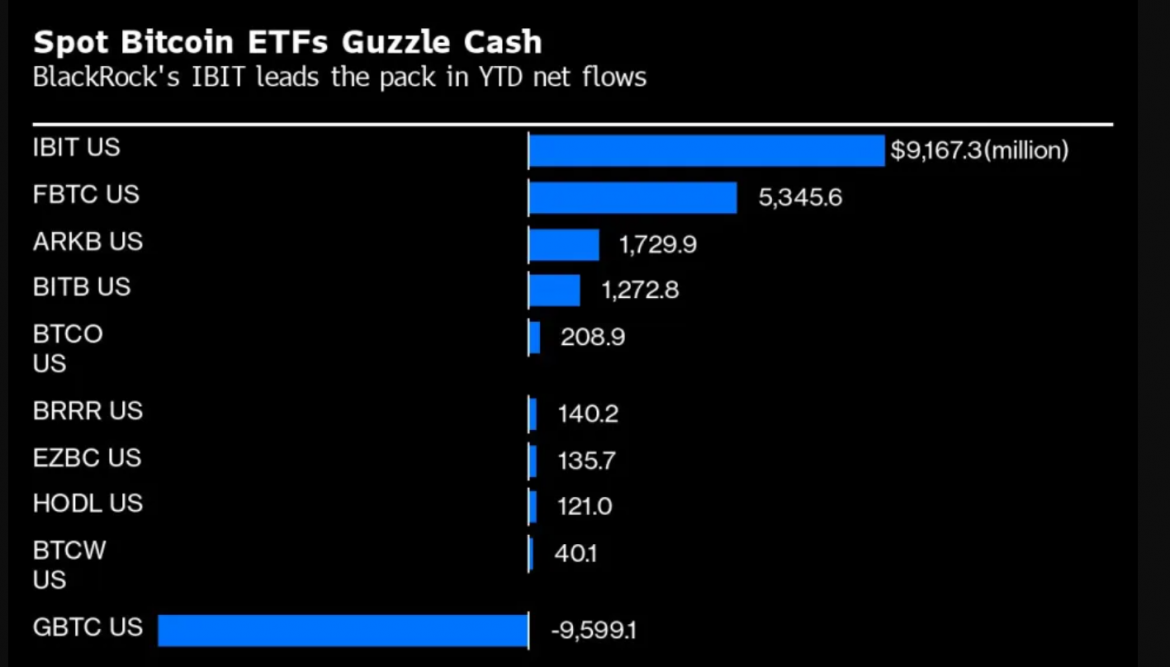

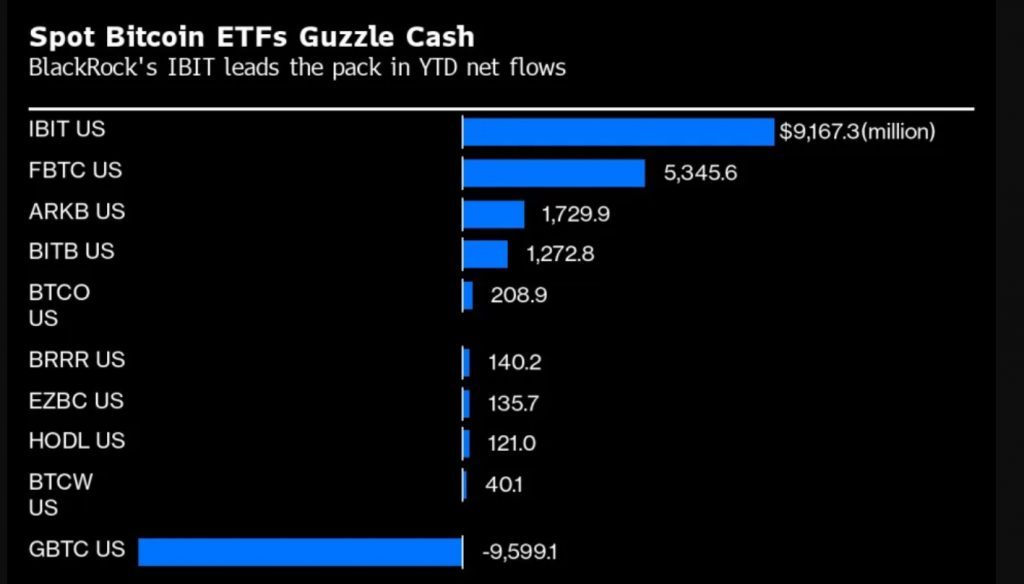

In a landmark moment for the crypto industry, the 10 US spot Bitcoin ETFs approved in January saw record volume on Tuesday, with over $10.3 billion worth of shares traded, surpassing a previous record set just the week before. Despite the billions withdrawn from the Grayscale Bitcoin Trust, these funds have collectively garnered a net inflow of $8.5 billion since their launch. Following BlackRock, Fidelity’s FBTC and ARK 21Shares’ ARKB are leading in terms of inflows.

Conversely, products associated with betting against Bitcoin also reached record levels. The ProShares Short Bitcoin Strategy ETF (BITI), with $82 million in assets, saw $300 million worth of shares traded on Tuesday.

Mike Cronan, president of ETF Insight, compares Bitcoin’s rise to the success of the ETF industry, noting that both were initially underestimated but have become undeniable forces. He emphasizes that Bitcoin is not just a decentralized currency but a network with far-reaching implications.