Bitcoin ‘s price is at a critical juncture. Despite the Federal Reserve’s recent 25 basis point rate cut, BTC has shown surprisingly little movement, continuing to hover around the $116,000 level.

All eyes are now on a massive $3.5 billion Bitcoin options expiry happening today, which could be the catalyst for the next major price move. Analysts are warning that if Bitcoin fails to clear a key resistance level, a significant correction could be imminent.

The Crucial $117,200 Bitcoin Resistance Level

Following the Fed’s policy shift, Bitcoin’s volatility has remained unusually subdued. Popular crypto analyst Rekt Capital has identified a specific level that traders must watch: $117,200.

He argues that a decisive daily close above this price is absolutely essential for Bitcoin to rally toward the next major target at $120,000. However, he also presents a bearish scenario.

If Bitcoin fails to close above $117,200, it could trigger a sharp correction all the way down to $105,000.

On-Chain Data Highlights Key Support

This analysis is supported by data from blockchain analytics firm Glassnode. They highlight $115,200 as the most important short-term support level to hold.

The firm notes that a stunning 95% of Bitcoin’s circulating supply is currently in profit. This means that if the price starts to fall, a large number of holders might be tempted to sell and realize their gains, potentially accelerating a downturn.

Glassnode agrees that a break below $115,200 could indeed “open the gates” for a correction toward $105,500.

A Record $3.5 Billion Options Expiry

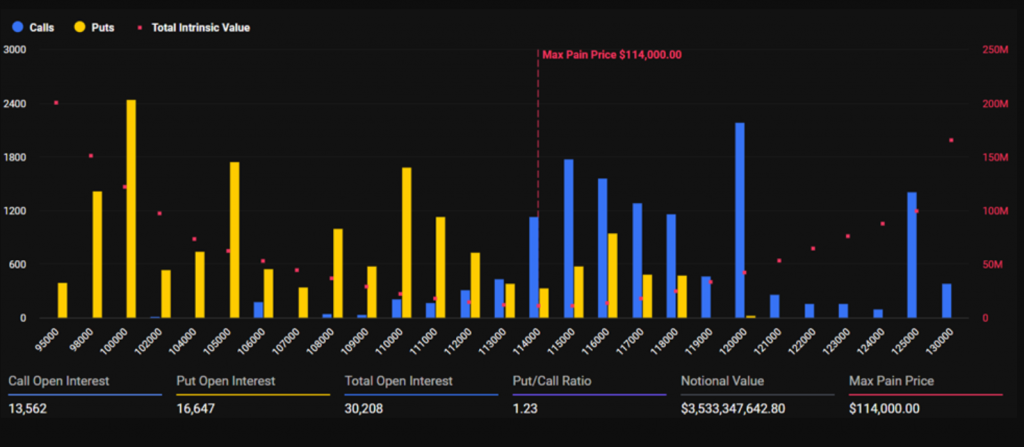

Today’s market activity is dominated by one of the largest BTC options expiries in history. A whopping 30,000 BTC options, worth approximately $3.53 billion, are set to expire on the Deribit exchange alone.

This event creates a tense standoff between bulls and bears:

- The overall put-call ratio is 1.23, indicating a bearish tilt in overall positioning.

- However, in the last 24 hours, the ratio dropped to 0.77, meaning call buying (bets on higher prices) has exceeded put buying.

The “max pain” price—the point that would cause the maximum financial loss to options holders—is $114,000. This is well below BTC’s current price. Analysts warn that large traders may attempt to push the price toward this level at settlement time to minimize their losses.

The outcome of this expiry will likely set the tone for BTC trajectory in the coming week.