The market just witnessed a fascinating anomaly. The January U.S. jobs report came in way hotter than expected, with 130,000 jobs added versus the 65,000 forecast—the strongest print since April 2025. This is the kind of data that typically crushes risk assets. Yet, Bitcoin did the exact opposite. The Bitcoin jobs report reaction was a defiant pump past $67,000, leaving traders scratching their heads and covering their shorts.

Analyzing the Unexpected Bitcoin Jobs Report Reaction

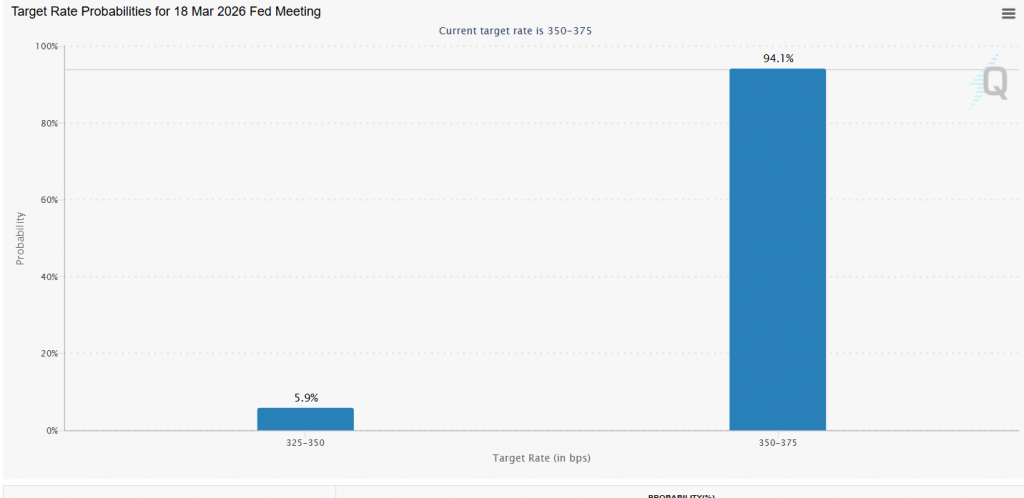

Let’s break down the cognitive dissonance. Strong jobs = strong economy = Fed stays hawkish = bad for Bitcoin. That’s the textbook playbook. And indeed, rate cut odds collapsed further. CME FedWatch now shows just a 6% chance of a March cut, down from 20% last week. Polymarket traders see only a 9% probability.

So why did BTC rip higher? Two possibilities. First, the market is front-running the peak of hawkishness. The data is strong, but the trajectory is slowing. Second, and more importantly, Bitcoin is increasingly trading on its own institutional flow dynamics, not knee-jerk macro reactions. The ETF inflow streak we’ve been tracking is providing real, structural bid support.

Market Outlook: Rate Cuts Delayed, Not Derailed

The immediate path is clear: no March cut. The market is now pricing the first move in June. This pushes the liquidity injection timeline further out, which should theoretically cap speculative froth. However, today’s price action suggests that expectations have been sufficiently reset. The market is no longer reliant on imminent cuts; it’s looking past the peak.

My Thoughts

This is the most interesting macro reaction I’ve seen in months. The Bitcoin jobs report reaction tells me that the market has already priced the “higher for longer” narrative to exhaustion. We are transitioning from a market that sells every hawkish data point to a market that looks through it. This is characteristic of a mature bull cycle bottoming process. The news is bad, but the price stops going down. That’s your signal. Institutions are using the strong dollar/hawkish Fed window to accumulate, not exit. When the cuts finally do come (likely June), the rally will already have a head start.