After narrowly escaping a devastating blow during the recent crypto winter, Bitcoin miners are now back in full survival mode. They’re investing billions in equipment and ramping up energy consumption to unprecedented levels ahead of an impending update to the digital currency’s code, which threatens their revenue streams.

This surge in activity follows a spike in the world’s largest cryptocurrency’s value, fueled by newly launched spot Bitcoin exchange-traded funds and an upcoming quadrennial event known as the halving, scheduled for April. Since plummeting by 64% in 2022 amid industry turmoil, Bitcoin has surged more than fourfold.

Data compiled by TheMinerMag from public filings shows that since February 2023, 13 top mining companies have placed orders for over $1 billion worth of specialized computers. Leading this investment spree are CleanSpark Inc. and Riot Platforms Inc., splurging as much as $473 million and $415 million, respectively, on mining rigs.

These machines are being acquired to enhance efficiency and secure favorable electricity rates, vital for miners who utilize energy-intensive computers to validate transactions on the blockchain and earn Bitcoin rewards. The quest for scale is crucial, enabling miners to negotiate better rates and drive down development costs, explains Asher Genoot, CEO of Hut 8 Corp.

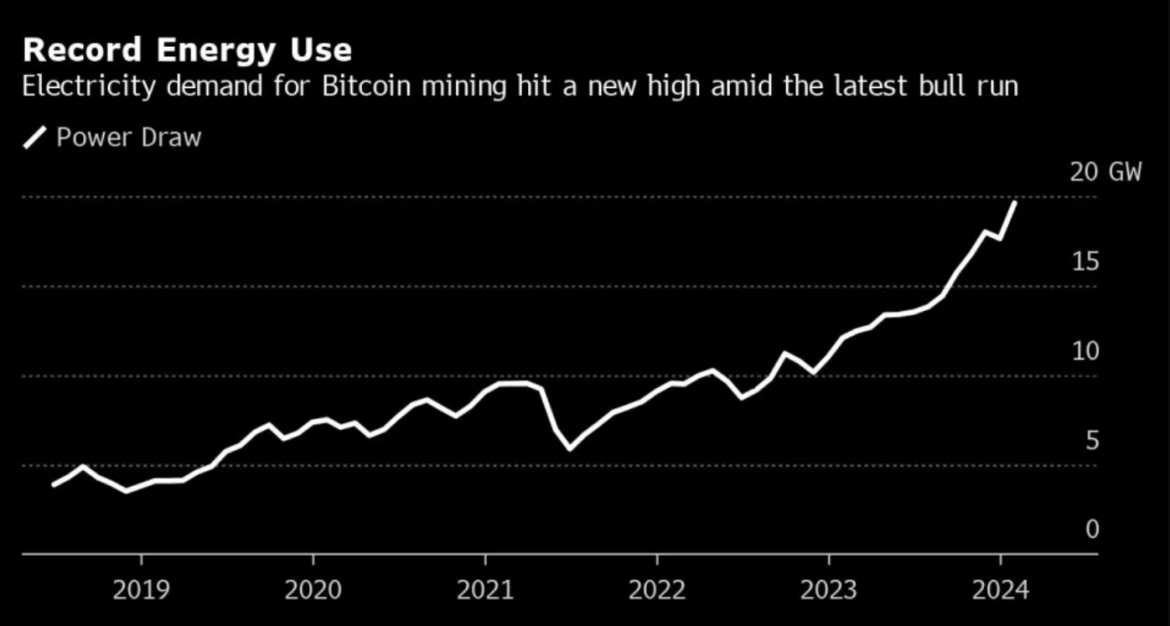

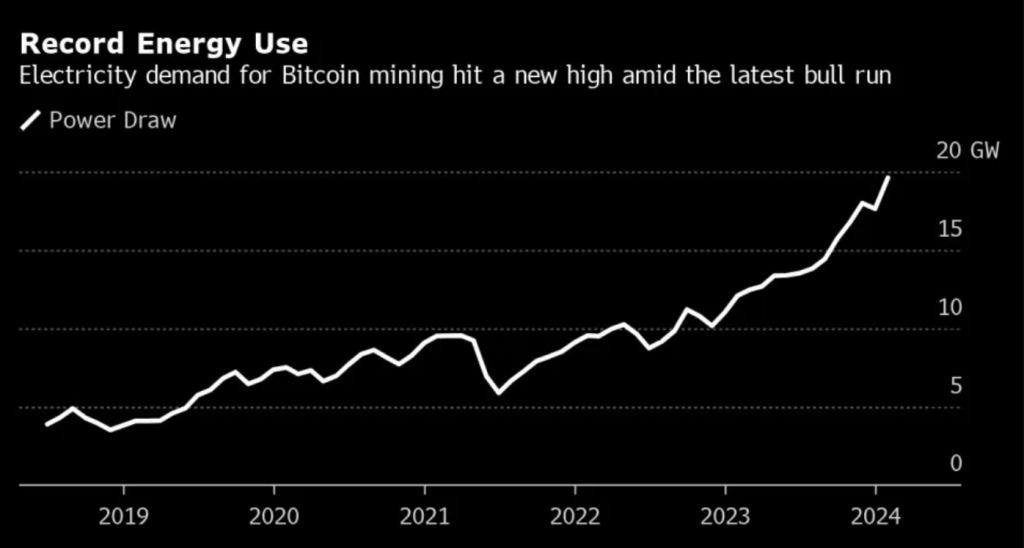

However, this intensified mining activity is taking its toll on energy consumption. Last month, miners drew a record 19.6 gigawatts of power, up from 12.1 gigawatts the previous year. This energy usage equates to powering about 3.8 million homes in Texas, where many mining operations are based.

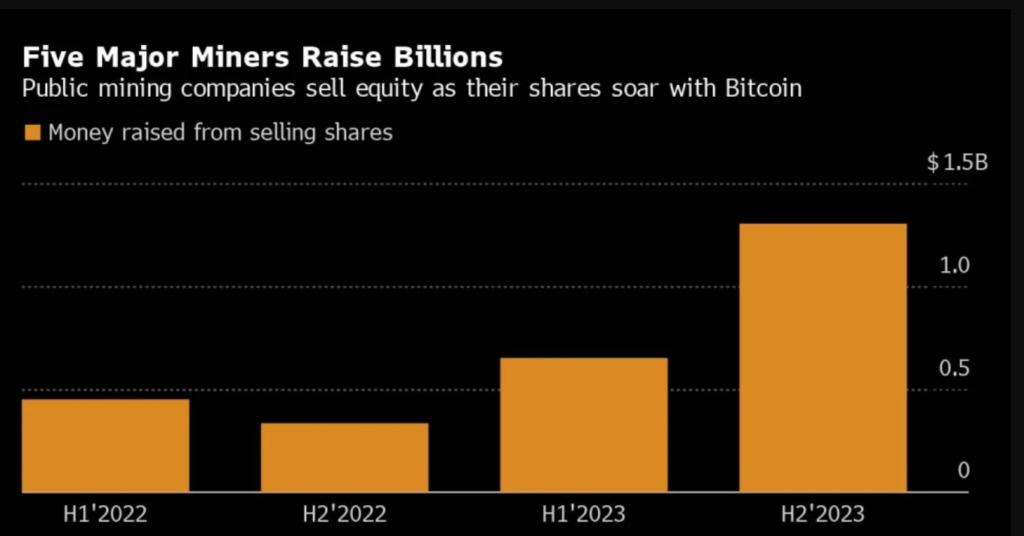

Despite concerns about the environmental impact of such high energy consumption, the rising price of Bitcoin has kept miners profitable. Shares of major mining companies like Marathon and CleanSpark have surged, allowing them to raise significant capital. Yet, the impending halving event will reduce rewards for miners, potentially squeezing profit margins.

With fierce competition among miners for rewards, evidenced by increasing mining difficulty, the industry faces risks of overscaling and potential bankruptcies. As Bitcoin’s value continues to fluctuate, miners must navigate carefully to remain profitable and sustainable in the long run.