Bitcoin’s Unstoppable Network Shows Its True Bitcoin Mining Resilience

A sudden dip in Bitcoin’s total hashrate sparked fears of a major mining crackdown this week. However, on-chain data reveals a powerful story of swift recovery and global strength, proving the remarkable Bitcoin mining resilience of a decentralized network. The event was a temporary blip, not a crisis.

Debunking the “Xinjiang Crash” Narrative

On December 18, reports swirled that regulatory inspections in China’s Xinjiang region had forced 400,000 miners offline, slashing hashrate by 8%. While a brief dip occurred, pool-level data tells a different story. A significant portion of the drop actually came from major North American pools like Foundry USA and Luxor, likely due to extreme cold weather affecting power grids.

Meanwhile, major China-linked pools saw a smaller, combined decline. Crucially, the hashrate rebounded almost completely within days. By December 17, most major pools had recovered, with the total network power just 20 EH/s below its peak. This rapid bounce-back challenges the narrative of a severe, lasting disruption.

The Bigger Picture: A Global, Robust Mining Ecosystem

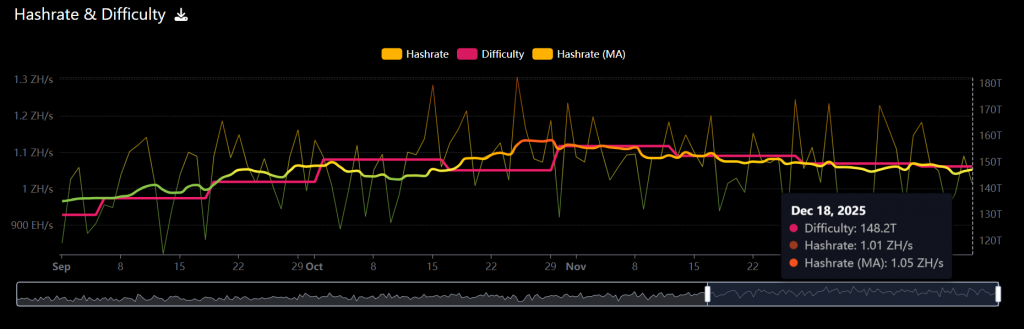

This event highlights a critical evolution in Bitcoin’s infrastructure. Mining is now a global industry. While regional policy shifts can cause short-term noise, the network’s health no longer depends on any single jurisdiction. In 2025 alone, the global hashrate soared from 700 EH/s to over 1 ZH/s (1,000 EH/s), fueled by massive institutional deployment and hardware upgrades worldwide.

This geographical distribution is the ultimate risk mitigator. It ensures the network’s security and continuous operation, regardless of local events. The system’s built-in difficulty adjustment will also soon recalibrate, offering relief to remaining miners.

My Take

This is a masterclass in Bitcoin mining resilience. The market’s muted price reaction to the initial scare is telling. Smart money understands the network’s distributed strength. Events like this are healthy stress tests that prove Bitcoin’s antifragility. For investors, it reinforces that the foundational security of the network is stronger than ever, which is a profoundly bullish long-term signal.