For the first time since 2018, Bitcoin October returns ended in the red, breaking the “Uptober” streak that crypto traders have come to rely on. Bitcoin closed October 2025 with a -3.69% monthly loss, proving that even the strongest months can stumble — though not without a few silver linings.

Bitcoin October Returns: Uptober Turns to Fuc*tober

October has historically been a bullish month for Bitcoin. However, this year, the market flipped the script. The month ended down 3.69%, marking the first negative October since 2018.

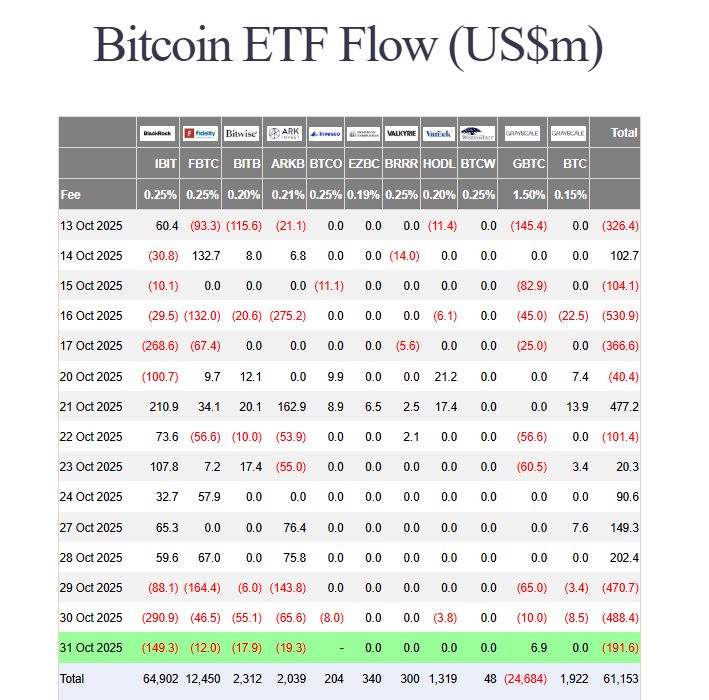

Despite optimism early in the month, the final week saw three consecutive days of spot Bitcoin ETF outflows, including $191.6 million on October 31 alone.

The last week closed deep in red, with total ETF outflows reaching $607.35 million.

But the full story doesn’t end in red ink.

Spot Bitcoin ETFs Still Net Positive

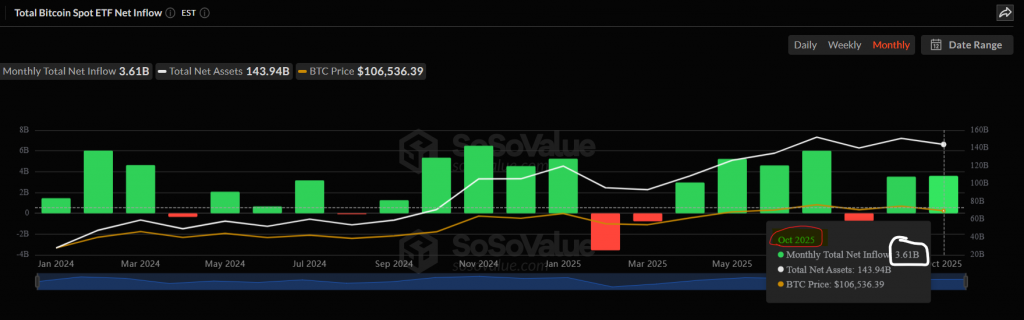

Surprisingly, even with a turbulent finish, total October inflows for spot Bitcoin ETFs remained positive — at $3.61 billion in net inflows.

That’s a strong sign of institutional demand and market resilience, especially considering the October 19 market crash and heavy volatility.

Despite traders cashing out late in the month, long-term holders and funds continued stacking sats.

A Month of Contrasts: ATH and Outflows

October 2025 wasn’t all pain. Mid-month, Bitcoin surged to a new all-time high of $126,000, a milestone that underscored the broader bull market trend.

Even as price corrected later, the achievement reinforced how far the asset has come since the previous cycle.

Global Backdrop: Trump and Xi Shake Hands

Adding to the intrigue, Donald Trump and Xi Jinping made global headlines after shaking hands — symbolizing hope for a permanent U.S.–China tariff truce.

Markets, both traditional and digital, briefly rallied on the optimism, giving investors a reason to stay cautiously bullish.

Final Thoughts: A Red Month With Orange Highlights

Sure, Bitcoin October returns were negative — the first “Uptober” to turn into “Fuc*tober.”

But even amid red candles, the month brought $3.61 billion in ETF inflows, a $126K all-time high, and renewed geopolitical optimism.

If anything, October proved that even when Bitcoin bleeds, the orange dots keep moving up and to the right.