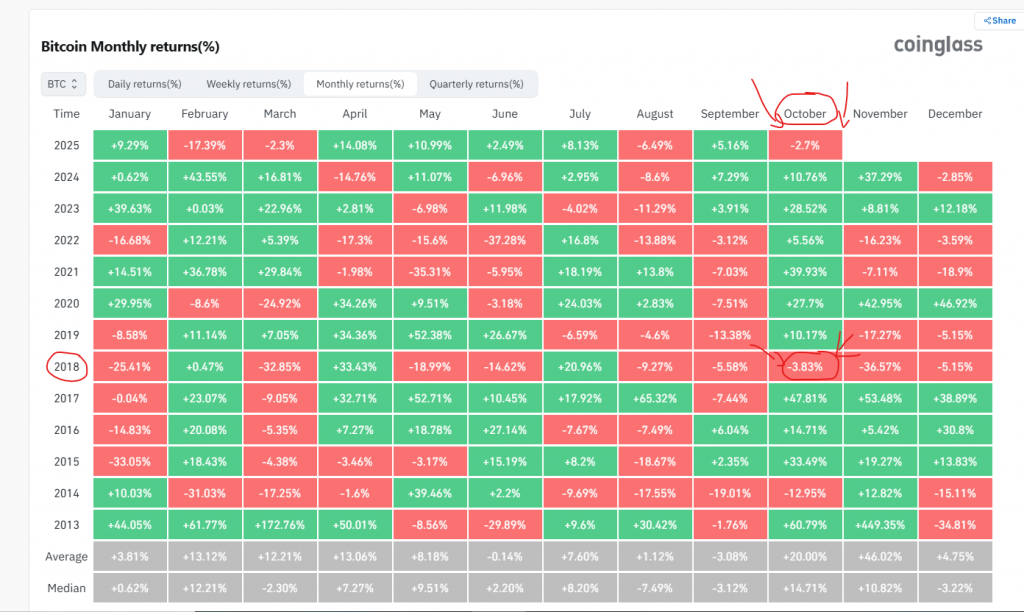

Brace yourselves, crypto fam! Bitcoin is teetering on the edge of a rare event—closing October in the red for the first time in seven years. Despite soaring to new all-time highs earlier this month, BTC is now struggling around $110,000, recording a 3.3% monthly drop. This isn’t just a minor dip; it’s a potential historic shift. So, what’s driving this Bitcoin October slump? Let’s unpack the alpha.

The Bitcoin October Slump Explained

At the heart of this downturn is massive profit-taking by long-term holders (LTHs). These are the OGs who’ve held through multiple cycles. On-chain data reveals they’ve been distributing coins since July 1, selling roughly 810,000 BTC. That’s a huge reduction from 15.5 million to 14.6 million BTC in their wallets. Surprisingly, Bitcoin still hit new highs twice amid this selling, showing intense demand. But analysts like Axel Adler Jr caution that continued profit-taking will limit upside moves. Essentially, the old guards are cashing in, creating a supply overhang.

Where Are the Retail Investors?

Meanwhile, retail participation has been shockingly weak. When BTC peaked at $126,000 on October 7, retail inflows averaged a meager 600 BTC per month—a tiny trickle compared to past bull markets. In contrast, whales are actively moving coins, with monthly inflows to Binance hitting around 5,600 BTC. This divergence suggests that mom-and-pop investors are sitting on the sidelines, likely spooked by volatility or waiting for a clearer trend. Without their FOMO, the market lacks a key catalyst.

November Outlook: Bullish Signals Remain

But here’s the good news: the foundation is still solid. Bitcoin recently tested the $106,000 support zone and held strong, with volatility easing—a sign of resilience. Data from Bitcoin Vector indicates that unrealized losses at these levels are just 1.3% of market cap, far from bearish territory. Many experts believe the bull cycle is intact, and a new all-time high could arrive before 2025 ends. So, while October might be a breather, November could ignite a powerful rebound.

My Thoughts

This slump is a healthy correction, not a breakdown. Profit-taking is natural after epic runs, and it shakes out weak hands. With institutional adoption growing and ETFs absorbing supply, I see this dip as a prime accumulation zone. Bitcoin’s resilience at key supports confirms the bull trend is alive. Don’t fear the red—embrace it as a buying opportunity.