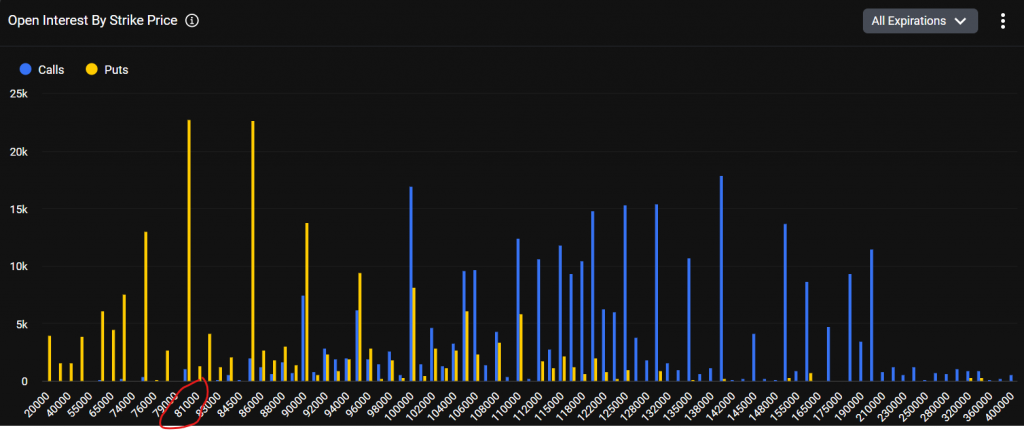

Bitcoin Options Market Flashes Red with $2 Billion Bet on Crash to $80K

The Bitcoin options market is screaming danger. In a dramatic shift, the $80,000 put option has become the single most popular contract on leading exchange Deribit, boasting over $2 billion in open interest. This surpasses the $85,000 put and dwarfs the once-dominant $140,000 call. This massive bearish positioning in the Bitcoin options market indicates that a significant number of traders are betting on—or hedging against—a crash below the critical $80,000 support level. The fear is palpable, but is this the final capitulation before a mighty rebound?

Analysts See a Necessary Flush Before a Rally

Despite the overwhelming bearish bets, many top analysts see this as a contrarian setup for a powerful rally. Swissblock analysts noted that Bitcoin often experiences one final momentum-driven drop to clear out liquidity in the $80,000-$82,000 zone. They argue this painful move would actually “create the strongest setup for a larger push upward.” This perspective is echoed by on-chain data from CryptoQuant, which shows clear capitulation among short-term holders—a classic bottoming signal. The key question is whether this is a standard correction within a bull market or the start of a deeper bear cycle.

Arthur Hayes: The Liquidity Tide is Turning

Adding a powerful macro perspective, BitMEX co-founder Arthur Hayes has weighed in. He predicts Bitcoin will likely hold above $80,000, though it may see one last dip into the low $80,000s. Crucially, he highlights that the Fed is ending its Quantitative Tightening (QT) policy on December 1, and U.S. banks have begun increasing lending. This improvement in dollar liquidity, he argues, is more important for Bitcoin’s price than a potential Fed rate cut. Hayes famously believes that with sufficient liquidity injection, BTC could still reach $200,000-$250,000 by year-end, regardless of the federal funds rate.

My Thoughts

This is peak maximum pain. The Bitcoin options market is often a contrarian indicator at extremes. The sheer volume of $80K puts creates a potential “gamma squeeze” to the upside if BTC stabilizes. When everyone is positioned for a crash, the smallest positive catalyst can trigger a violent short squeeze. Combined with Hayes’ liquidity thesis, I believe we are in the final fearful stage before a monumental rally. The weak hands are being shaken out, transferring coins to steadfast long-term holders.