Bitcoin’s powerful rally may be running out of steam. A ominous chart pattern is flashing a strong warning sign, suggesting a significant correction could be on the horizon. Meanwhile, all eyes are on Federal Reserve Chair Jerome Powell’s upcoming speech, which could be the catalyst that decides the market’s next major move.

A Bearish Wedge Pattern Nears Its End

On the weekly chart, Bitcoin has been forming a classic rising wedge pattern. Analysts often view this pattern as a bearish signal, especially after a long uptrend.

Here’s how it formed:

- The upper trendline connects the sequence of higher highs since March.

- The lower trendline links the higher lows since August 2024.

These two lines are now converging, dramatically narrowing the price channel. Historically, this setup often resolves with a sharp bearish breakout to the downside.

Momentum Indicators Show Worrying Divergences

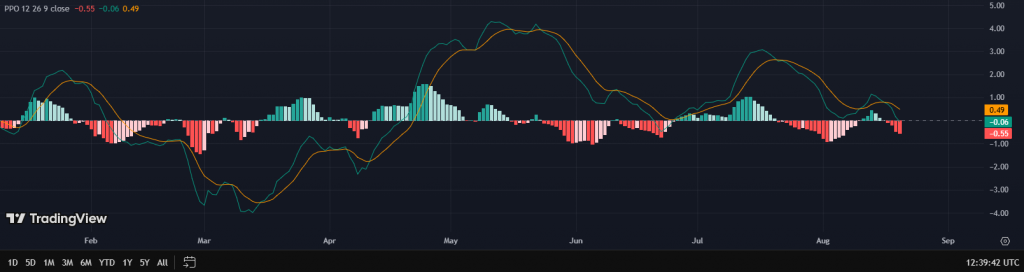

The bearish case isn’t just based on the wedge. Key momentum indicators are also showing bearish divergence, which is a major red flag.

- The Relative Strength Index (RSI) peaked back in March and has been making lower highs ever since, even as the BTC price climbed.

- The Percentage Price Oscillator (PPO) is also trending slowly downward.

This divergence means that while the price was rising, the underlying momentum was actually weakening—a classic sign of an exhausted rally.

What’s the Potential Downside Target?

If the rising wedge pattern plays out as expected, the technical target is sobering. By measuring the height of the pattern at its widest point and projecting it downward from the potential breakout point, analysts see a possible drop toward $60,370.

A daily close above the key $125,000 resistance level would invalidate this entire bearish outlook.

The Catalyst: Jerome Powell’s Jackson Hole Speech

The immediate trigger for a potential move could be this week’s Jackson Hole Economic Symposium. Fed Chair Jerome Powell’s speech is always a major market event, but it carries extra weight this year.

The Fed is stuck in a difficult position:

- Rising unemployment and persistent inflation create a stagflationary environment.

- New tariffs could push inflation even higher.

- There is immense political pressure to cut interest rates.

A dovish signal from Powell (hinting at rate cuts) could boost Bitcoin. However, a hawkish tone (suggesting rates will stay high) would likely confirm the bearish technical outlook and could be the catalyst for the crash.