A perfect storm is brewing for Bitcoin, threatening to unleash a devastating Bitcoin price crash. Institutional investors are executing a mass exodus, pulling a staggering $903 million from spot ETFs in just four days. Combined with increased selling pressure from miners, this could shatter key support levels and send the price plummeting.

The Great Institutional Exodus

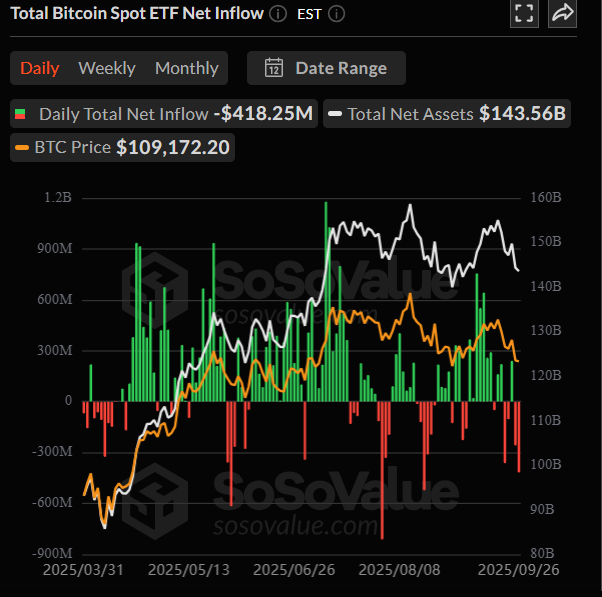

The data reveals a brutal reversal of sentiment. The steady stream of institutional capital that propelled Bitcoin to all-time highs has now turned into a flood of outflows. This $903 million withdrawal from September 22-26 marks a stark contrast to the $5 billion+ monthly inflows seen during the peak rally.

This correlation is critical. When institutions buy, the price soars. When they flee, the Bitcoin price crash risk becomes terrifyingly real. Their retreat removes the single most important source of demand from the market.

Miners Join the Selling Frenzy

Making a bad situation worse, Bitcoin miners have started liquidating their holdings. On-chain data shows miner reserves have declined, indicating they are selling BTC to cover costs or lock in profits. This dumps additional supply onto the market exactly when it’s least needed, intensifying the downward spiral.

Bitcoin Price Crash : How Low Can It Go?

With two major selling forces aligned, the technical outlook is grim.

- Nightmare Scenario: If ETF outflows continue and miner selling persists, the next major support level is $107,557. A break below this could trigger a steeper collapse.

- Recovery Hope: For any chance of a rebound, bulls must defend the current level and push the price back above $110,034 to target $111,961.

The evidence is overwhelming. The institutional frenzy is over, replaced by fear and profit-taking. The path of least resistance is now down, and the feared Bitcoin price crash could be just getting started.