The market just got a brutal reminder that good news can be a sell signal. A major Bitcoin price crash is underway, with BTC plummeting for four consecutive days to its lowest level in weeks. This severe downturn occurred despite the Federal Reserve delivering a widely expected rate cut and a positive Trump-Xi trade deal. So, what went wrong? The devil is in the details, and the reaction was far more hawkish than the market hoped.

Hawkish Fed and “Sell the News” Fuel the Drop

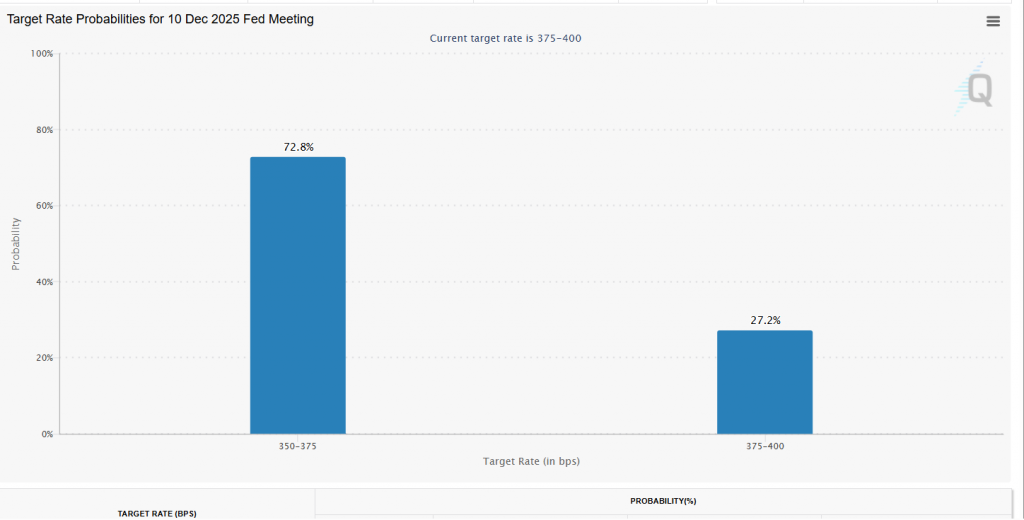

The collapse is primarily a classic “sell the news event.” Both the Fed’s cut and the trade deal were almost 100% priced in, leaving no room for a surprise rally. However, the real catalyst was Jerome Powell’s surprisingly hawkish tone. He explicitly stated that a December rate cut is not guaranteed. Consequently, the odds for a December cut plummeted from over 90% to 72%. This shift spooked traders across risk assets, leading to a simultaneous drop in both stocks and crypto.

Massive Liquidations and ETF Outflows Amplify Pain

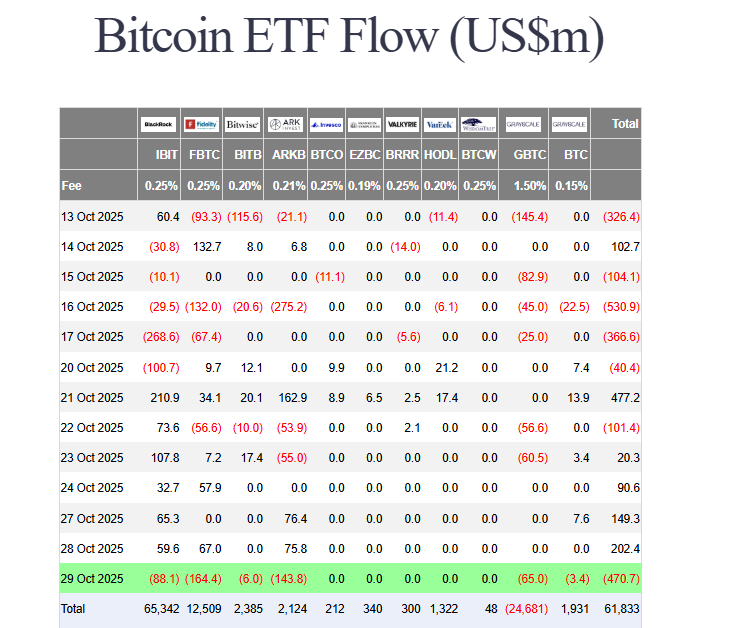

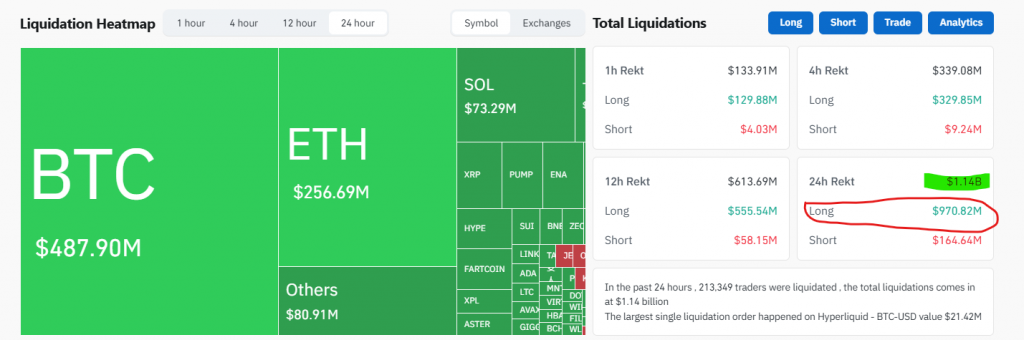

The selling pressure ignited a cascade of liquidations. In the past 24 hours, over $483 million in leveraged Bitcoin positions were wiped out. This massive deleveraging is evident as total open interest in BTC futures has plunged from to $73 billion afr behind from its month all time high of $94B. Meanwhile, the spot ETF picture turned ugly. On Wednesday, these funds bled $470 million, with Fidelity, Ark, and BlackRock all seeing significant outflows. This institutional selling directly exacerbated the Bitcoin price crash.

Technical Picture Warns of More Downside

Technically, the situation looks precarious. Bitcoin was rejected at the $116,370 resistance level earlier this week, and the momentum has turned sharply negative. Analysts are now watching for a potential “death cross” pattern to form on the daily chart, where the 50-day moving average crosses below the 200-day. This bearish signal could open the door for a further decline toward the $100,000 psychological level.

My Thoughts

This is a painful but necessary market reset. The excessive leverage has been flushed out, creating a healthier foundation. While the short-term sentiment is bearish, the core bullish thesis remains intact. This dip may present a strategic buying opportunity for those who believe in the long-term cycle, but caution is warranted until the technical structure improves.