The selling pressure is mounting as the Bitcoin price drops below the critical $110,000 level. Currently trading around $105,837, Bitcoin is now down 14% from its recent all-time high. The decline is being fueled by a second straight day of major outflows from spot Bitcoin ETFs, shaking investor confidence.

ETF Outflows Drive the Sell-Off

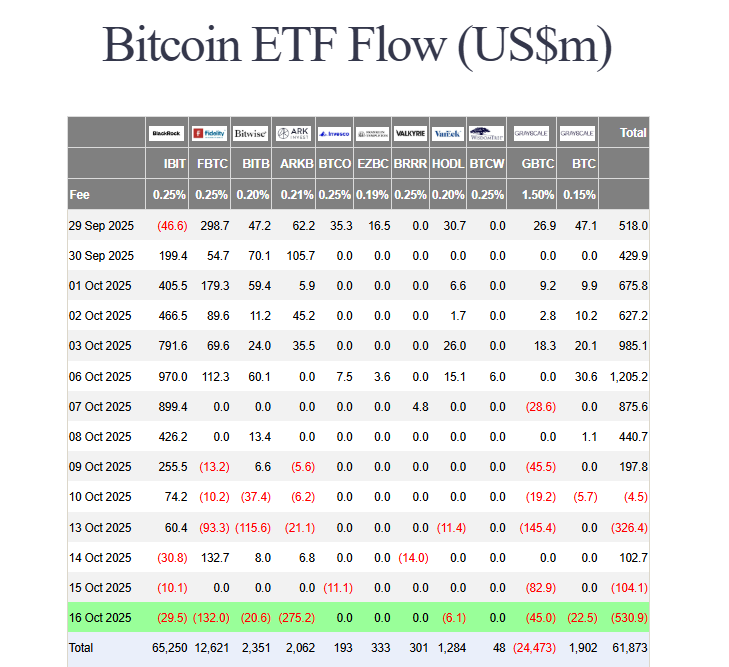

The data tells a clear story. On October 16, U.S. spot Bitcoin ETFs saw a massive $536 million walk out the door. This marks the second consecutive day of significant outflows, suggesting institutions are taking profits after the big rally. ARK Invest’s ARKB fund led the withdrawals with $275 million, followed by Fidelity’s FBTC with $132 million.

This institutional selling is creating a major headwind. When these funds have to sell Bitcoin to meet redemptions, it adds direct selling pressure to the market. This comes at a time when trader sentiment was already fragile due to global economic concerns.

Technical Picture Shows Bitcoin price drops

The technical outlook for Bitcoin has turned cautious. The Bitcoin price drops have pushed it against the lower Bollinger Band, which often signals rising volatility and potential for bigger moves. All major moving averages are now flashing sell signals, indicating a bearish near-term trend.

However, it’s not all doom and gloom. The current $104,000-$108,000 zone has become a crucial support area. If Bitcoin can hold here, a bounce back toward $113,000 is possible. But if this support breaks, a further decline toward $102,000—or even $100,000, as some analysts warn—could be next.

My Thoughts

This is a healthy, though painful, correction after a huge run-up. ETF flows were the rocket fuel for the rally, so it’s natural that outflows would cause a pullback. The key is whether long-term holders see these prices as a buying opportunity. If the $104K support holds, we could quickly regain momentum. If not, we may be in for a deeper cleanse before the next leg up.