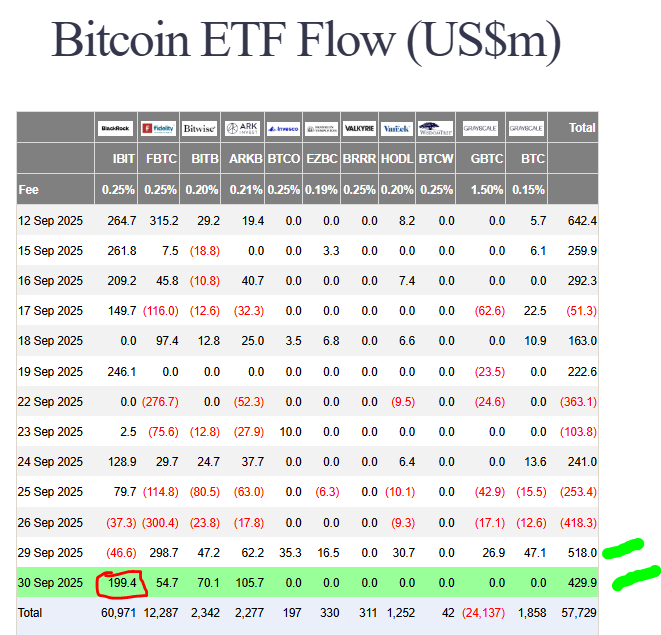

The Bitcoin price is demonstrating impressive strength, holding firmly above $116,000 as a tidal wave of institutional capital returns. With spot Bitcoin ETFs recording a massive $429.9 million in daily inflows—one of the the highest in weeks with yesterday ETF inflow—the stage is set for a potential powerful breakout. Our latest Bitcoin price prediction analyzes whether this momentum can shatter key resistance and fuel a run toward new all-time highs.

ETF Inflows Fuel a Bullish Bitcoin Price Prediction

The data is overwhelmingly bullish. The recent influx of $429.9 million into spot ETFs marks a decisive return of institutional demand. Giants like BlackRock’s IBIT led the charge with $199.4 million, signaling strong conviction from heavyweight investors.

This brings the total monthly inflows to a staggering $3.53 billion, creating a solid foundation for a strong Q4. According to Analysts, this structural demand, combined with large wallet accumulation, sets the stage for a new Bitcoin price prediction that projects a potential surge to $180,000 before the year ends.

Bitcoin Price Prediction: The Key $115,000 Level

From a technical perspective, our Bitcoin price prediction hinges on a single, critical level: $115,000. Bitcoin is currently consolidating just below this resistance.

- Bullish Scenario: A decisive daily close above $115,000 could trigger a momentum burst, opening a clear path to retest the August high near $124,000 and beyond.

- Bearish Scenario: Failure to break higher could lead to a retest of the $113,000 support, with a deeper fallback to $110,000 if that level fails.

The 200-day simple moving average at $104,920 provides a strong long-term safety net for bulls.

The Verdict

The current Bitcoin price prediction is cautiously optimistic. The combination of massive ETF inflows and solid technical support creates a favorable environment for a breakout. All eyes are on the $115,000 resistance; a clean break above it will likely confirm the next leg up in this historic bull market.