Bitcoin Price Outlook Strengthens Amid Macroeconomic Shift

The Bitcoin price outlook is gaining bullish conviction as BTC demonstrates resilience above $92,000. This stability arrives alongside a monumental shift in macroeconomic expectations, creating a powerful fundamental tailwind for crypto’s premier asset. The key question is whether Bitcoin can now convert this support into a decisive assault on the $100,000 milestone.

Macro Catalyst: Fed Rate Cut Probability Hits 92%

A seismic shift in trader sentiment is providing rocket fuel for Bitcoin. Prediction market platform Kalshi now shows a 92% probability that the Federal Reserve will execute three interest rate cuts in 2025. This is a record-high expectation, signaling the market’s firm belief that a significant monetary policy pivot is imminent. Lower rates historically weaken the dollar and increase the attractiveness of scarce, non-yielding assets like Bitcoin, creating a near-perfect macro backdrop for a sustained rally.

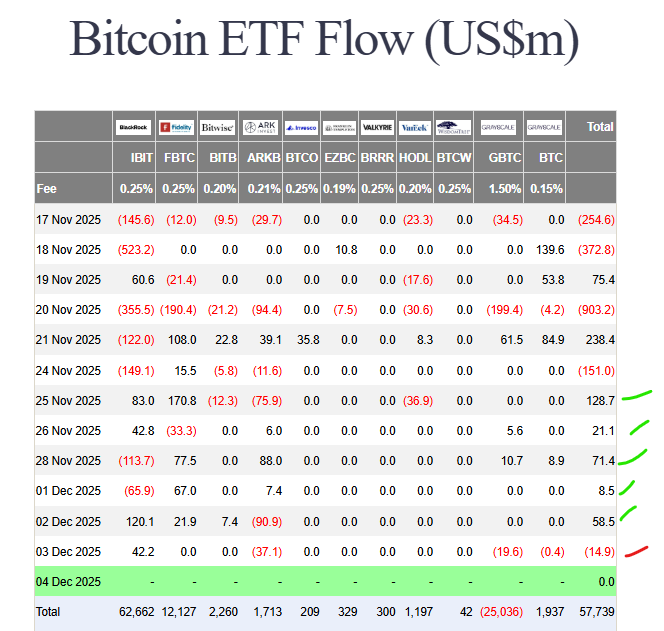

Bitcoin ETF has recorded yesterday on December 3rd a negative net outflow of $14.9M after5 straight 5 days of positive net inflow . We should Highlight that Blackrock has bought Bitcoin for 2 straight days now.

Technical Battle at the $92K – $94K Gateway

Bitcoin’s immediate fate hinges on its ability to conquer and hold the $92,000 to $94,000 resistance zone. Analysts note that a clean breakout and daily close above this area would open a clear path toward $100,000. The technical indicators support this potential: the Chaikin Money Flow (CMF) is positive at 0.19, indicating strong buying pressure, and the MACD has completed a bullish crossover, signaling regained short-term momentum.

Conversely, rejection from this level could trigger a pullback toward $90,000 support. The current consolidation above $92K is therefore a critical inflection point.

My Thoughts

The convergence here is exceptionally powerful. Bitcoin isn’t just rallying in a vacuum; it’s firming up as the market prices in a profoundly different liquidity environment for 2025. The 92% rate cut probability is not a minor forecast—it’s the market screaming that easy money is coming. This fundamentally supports higher valuations for risk assets. If Bitcoin can break this technical resistance on a weekly close, the rally to $100,000 could occur faster than many anticipate, fueled by both technical breakout dynamics and macroeconomic repricing.