The Bitcoin price prediction is dominating conversations again as BTC storms back into the $114,000 range. After a volatile September, the market is at a critical inflection point. Our latest analysis reveals the exact price level that will determine if Bitcoin is headed for a powerful Q4 rally or a painful correction.

Bitcoin Price Prediction: The Battle Between Bulls and Bears

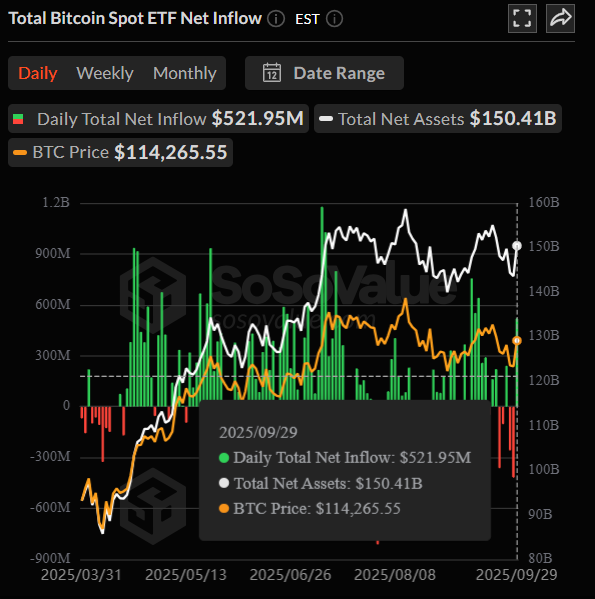

Bitcoin is currently trading between $114,400 and $114,600, caught in a fierce battle. On one side, spot Bitcoin ETFs are showing inconsistent but sometimes strong daily inflows. On the other, soaring derivatives open interest is creating a powder keg for explosive volatility.

The key support to watch is $108,000, which held firm during recent dips. The immediate resistance is the $113,000-$116,000 band. Whichever way this tight range breaks will set the tone for the next major move.

The Bullish Bitcoin Price Prediction: A Path to $120,000

Our bullish Bitcoin price prediction hinges on one crucial event: a decisive break and hold above $116,000. If buyers can achieve this, it would likely trigger a cascade of short liquidations and ignite FOMO buying.

This could quickly propel the price toward the $118,000-$120,000 zone. Furthermore, massive on-chain accumulation by whales and declining exchange reserves suggest that a supply squeeze could be brewing, potentially fueling an even larger move.

The Bearish Risks: A Warning of a Drop to $105,000

However, our Bitcoin price prediction also carries a stark warning. If Bitcoin fails to hold the $108,000 support level, it would signal a major breakdown. This could trigger a wave of selling, potentially sending the price tumbling toward $105,000 or lower.

Key risks include sudden ETF outflows, miner selling, or an unexpected macroeconomic shock that saps risk appetite from the entire market.

The Final Verdict

The current Bitcoin price prediction presents a cautiously bullish outlook, but the path is fraught with volatility. The $108,000 to $116,000 range is the entire game. A breakout above the high end opens the path to $120,000, while a breakdown below the low end risks a plunge to $105,000. Traders should brace for a turbulent but potentially rewarding October.