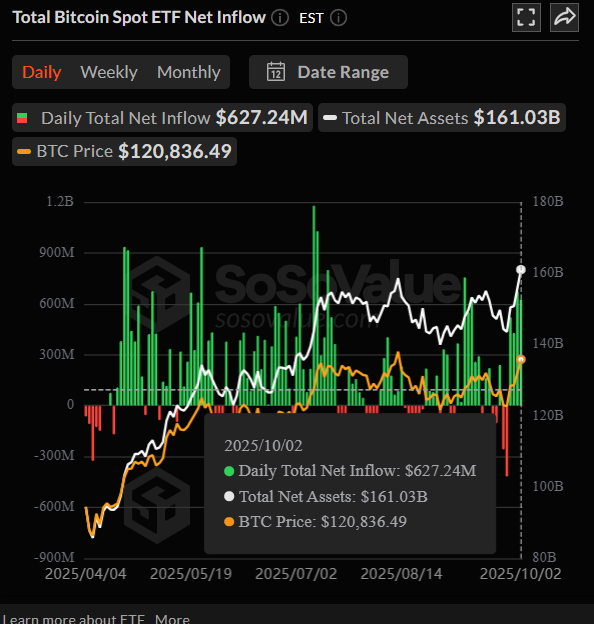

Bitcoin has surged past $120,000, approaching its all-time high. This powerful rally is fueled by massive institutional demand, with spot ETFs recording $627 million in inflows over four consecutive days. Consequently, Wall Street is issuing bold new forecasts, making the current Bitcoin price prediction a focal point for investors.

Wall Street’s Bullish Bitcoin Price Prediction

Major financial institutions are driving the optimistic narrative. Specifically, Citigroup issued a new Bitcoin price prediction, projecting a rise to $181,000 within the next 12 months. The bank cites potential ETF inflows of $7.5 billion by year-end as a primary catalyst.

However, analysts remain cautious, noting that a weakening global economy could push prices down to $83,000. Meanwhile, JPMorgan analysts observe a growing “debasement trade,” where retail investors flock to Bitcoin and gold as hedges against inflation and fiscal uncertainty.

Key Drivers Behind the Rally

The recent Bitcoin price prediction uptick is supported by several factors. Firstly, relentless ETF buying demonstrates strong institutional conviction. Secondly, the options market shows heavy trader interest in the $100,000–$120,000 range, with some speculative bets placed as high as $300,000.

Furthermore, the broader crypto market is rallying, and historically, the fourth quarter is a bullish period for Bitcoin. This combination of technical and fundamental strength provides a solid foundation for continued growth.

The Final Outlook

Ultimately, the current Bitcoin price prediction remains overwhelmingly positive. While volatility is always a factor, the convergence of institutional demand, favorable seasonality, and macroeconomic trends suggests the path of least resistance is still up.