Undeclared Strength: Bitcoin Price Resilience Shines Through Geopolitical Shock

In a stunning display of maturity, Bitcoin is not flinching. Despite a sudden U.S. military strike in Venezuela, the price has not only held but climbed, firmly reclaiming ground above $91,000. This remarkable Bitcoin price resilience signals a potential decoupling from traditional geopolitical panic and underscores the asset’s growing strength.

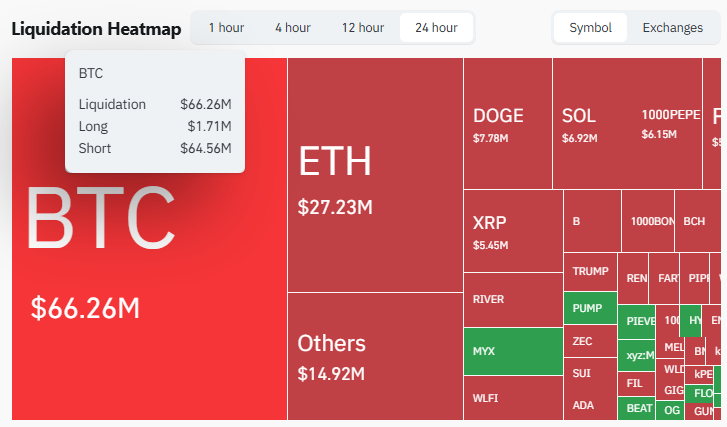

Why isn’t BTC selling off? Prominent analyst Michael van de Poppe argues this was a “planned and coordinated attack” that has “already passed us.” The market is interpreting it as a contained event, not the opening act of a prolonged, uncertain conflict. Consequently, the probability of a major spillover causing sustained negativity is seen as low. The price action confirms this thesis, with $64 million in short positions liquidated in the last 24 hours as bulls held their ground.

Analysts Highlight a New Paradigm for Bitcoin Price Resilience

This reaction marks a potential shift. Historically, Bitcoin has shown volatility during sudden geopolitical escalations, like the Iran-Israel incidents in 2025. However, analysts note a key difference: the market “nukes” when it expects worsening conditions. In this case, the immediate, decisive action appears to have limited follow-on risk, allowing traders to look past the headline.

Furthermore, the sustained hold above the psychologically crucial $90,000 level is itself a bullish technical feat. It suggests accumulation and conviction are overpowering knee-jerk fear. This Bitcoin price resilience builds a stronger foundation for the next leg up, transforming a potential resistance zone into a new support floor.

My Thoughts

This is quietly bullish behavior. The ability to absorb a genuine geopolitical shock without breaking key support is a hallmark of a strong market. It indicates that the current rally is being driven by deeper fundamentals—like liquidity and institutional adoption—rather than speculative hype. This resilience could encourage more institutional capital, which fears volatility, to enter the space. It signals that Bitcoin is graduating as a true macro asset.