A Fragile Rebound: Bitcoin Price Risk This Week

Bitcoin snapped back 4.6% today, briefly touching $88,146 following the Bank of Japan’s rate decision. However, this rebound rests on shaky ground. A colossal $2.7 billion options expiry on Friday, combined with persistent ETF outflows and a ominous technical pattern, creates a perfect storm of Bitcoin price risk. The path of least resistance may still point sharply lower.

The $2.7 Billion Options Expiry: A Gravity Well for Price

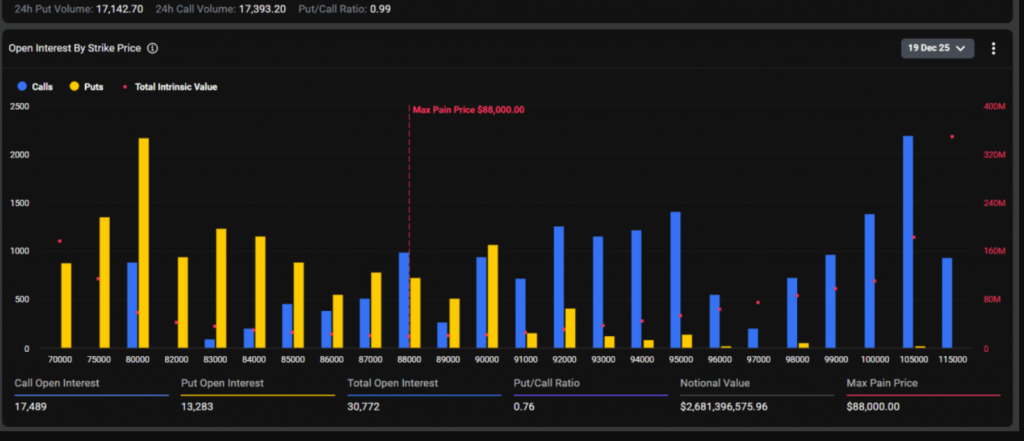

All eyes are on Deribit’s Friday expiry of over 31,000 Bitcoin options contracts. The “Max Pain” price—where most contracts expire worthless—is pinned at $88,000, just above current levels. This often acts as a magnetic pull for spot price as expiry approaches.

While the put/call ratio of 0.8 shows more bullish bets open, the largest open interest clusters are at $100,000 (calls) and $85,000 (puts). This sets up a high-stakes battle. Major expiries like this frequently trigger intense volatility, and with weakening underlying demand, the bears may have an edge.

Technical and On-Chain Headwinds Mount

The charts reveal a troubling structure. Bitcoin is trading within what appears to be a large bearish flag pattern on the daily timeframe. This continuation pattern often resolves with a breakdown, projecting a move toward $80,000 or lower.

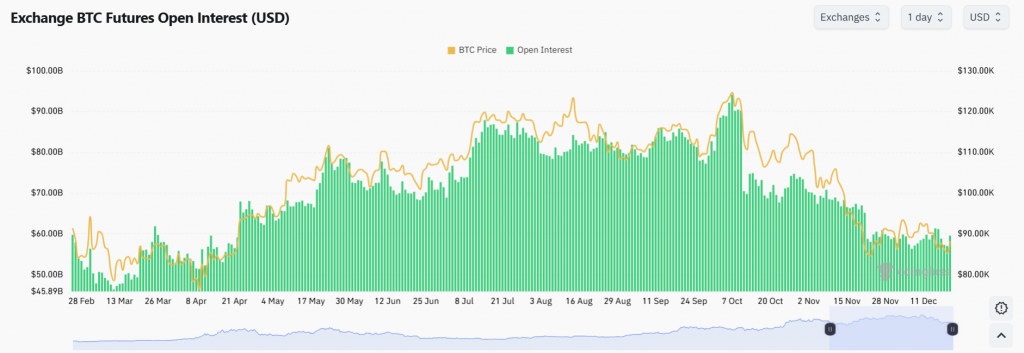

On-chain data confirms weakness. Total open interest has plummeted from $94 billion in October to $59 billion, signaling a massive flush of leverage and speculative demand. Meanwhile, Bitcoin ETFs have seen consistent outflows, losing another $161 million recently.

The Macro and Institutional Backdrop

The rebound followed a BoJ hike that was fully priced in, offering only temporary relief. The larger narrative is one of institutional caution and macro uncertainty. Until ETF flows turn positive and price reclaims key moving averages, the bounce is best viewed as a counter-trend rally within a larger corrective phase.

My Take

This is a classic “bull trap” setup. The bounce is convincing enough to lure in buyers, but the underlying structure is damaged. The confluence of the options expiry gravity, weakening leverage, and a textbook bear flag significantly raises the Bitcoin price risk for a sharp drop toward $85,000, then $80,000. My strategy here is caution. Any long positions need a tight stop below $85,000. A close above $93,750 is needed to invalidate this bearish outlook.