Flash Crash: Bitcoin Price Risks Mount as Geopolitics Spark $850M Liquidation

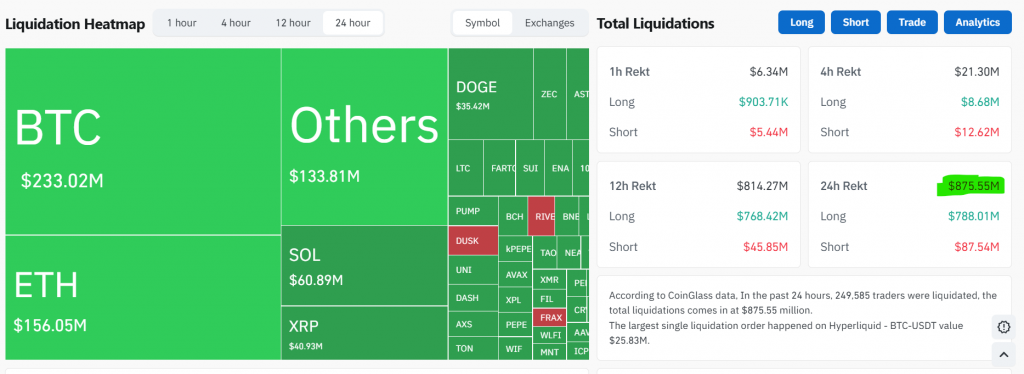

The market just got a brutal wake-up call. Bitcoin price risks escalated dramatically as new Trump tariffs targeting eight European nations over the Greenland dispute triggered a violent 3% flash crash to $92,089. This geopolitical shockwave liquidated over $875 million in crypto positions in 24 hours, with a staggering $800 million coming from wiped-out long bets. As gold surges to new highs, capital is fleeing risk, and BTC is firmly in the crosshairs.

This wasn’t organic selling. It was a systemic deleveraging event. The rally toward $98k was exposed as fragile—primarily driven by derivatives and short squeezes, not solid whale accumulation. On-chain data reveals large holders are actually closing long positions and opening shorts, signaling a lack of conviction in immediate upside. With the tariff standoff escalating and the EU preparing $100B in retaliatory measures, the risk-off mood is just beginning.

Analyzing the Key Bitcoin Price Risks This Week

Beyond geopolitics, two more storms are brewing. First, the market structure is weak. Analysts at 10x Research confirm the recent rebound lacked leverage and real demand, calling it a potential “bear market rally.” Bitcoin remains below its critical 365-day moving average near $101k, a key bull/bear boundary it has failed to reclaim.

Second, and perhaps more dangerously, is the looming Bank of Japan (BOJ) rate decision. With Japanese government bond yields spiking to historic highs, the BOJ is under immense pressure to hike rates. Such a move could unwind global carry trades, potentially triggering a liquidity crisis that would crash Bitcoin alongside other risk assets. The macro screws are tightening.

My Thoughts

This is a dangerous confluence of events. The tariff panic reveals how sensitive crypto still is to geopolitical liquidity shocks. The lack of real whale buying during the rally was a major red flag we highlighted. Now, with the BOJ wildcard, the path of least resistance is lower in the short term. Key support is $90,000—a break below could trigger a swift move toward $86k. Traders should dial down leverage and prepare for volatility. This isn’t the end of the bull market, but it is a severe test that must be respected.