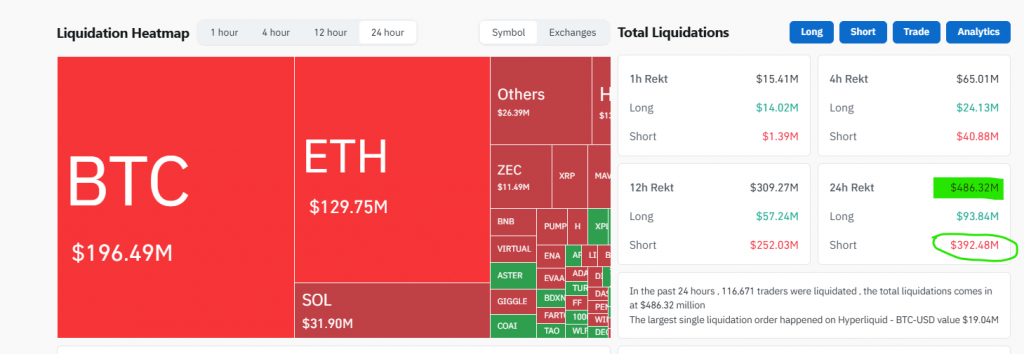

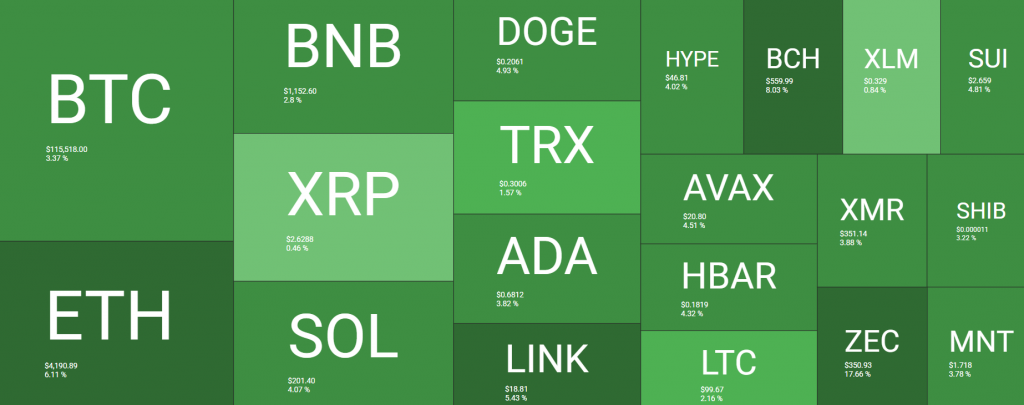

Bitcoin price just smashed through a critical barrier, surpassing $115,000 for the first time in two weeks. This powerful weekend breakout triggered a massive short squeeze, liquidating $347.5 million in bearish bets and confirming a decisive shift in market momentum.

The rally was fueled by a perfect storm of positive catalysts. First, growing optimism about a US-China trade deal framework provided a major macro tailwind. Second, traders are pricing in a near-certain 96.7% probability of a Fed rate cut this week. These factors combined to create a classic risk-on environment.

Altcoins joined the party with impressive gains. Ethereum surged 6% to break $4,180, while Solana jumped 5.7%. This broad-based strength indicates the move has depth beyond just Bitcoin dominance.

Bitcoin Price Sustainable Trend or Short-Term Spike?

Analysts believe this isn’t just a temporary pump. According to BTC Markets analyst Rachael Lucas, these moves represent a “sustainable trend driven by tightening on-chain supply, technical indicators, and macroeconomic support.” The liquidation of $347 million in shorts acted as rocket fuel, forcing bears to cover their positions and accelerating the upward move.

Looking ahead, the traditional “Christmas Rally” could provide the next leg up. Several analysts now project a move into the $130,000-$150,000 range by year-end, especially if the Fed follows through with expected rate cuts and trade tensions continue easing.

My Thoughts

This breakout is technically significant. Holding above $115,000 was crucial for maintaining the bullish structure after weeks of consolidation. The combination of a short squeeze, positive macro news, and strong altcoin participation suggests this rally has legs. With the Fed meeting and US-China talks ahead, we could be entering the most explosive phase of the 2025 bull market.