Bitcoin Price Swings on Conflicting U.S. Jobs Data as Fed Path Murkier Than Ever

Bitcoin experienced sharp Bitcoin price swings moments after the release of critical U.S. employment figures, initially spiking above $87,000 before retreating as traders digested a report filled with conflicting signals. The data presented a puzzle: stronger-than-expected job growth suggests economic resilience, but a rising unemployment rate hints at underlying weakness, leaving the Federal Reserve’s next move—and Bitcoin’s near-term trend—in doubt.

The Data Duel: Strong Payrolls vs. Rising Unemployment

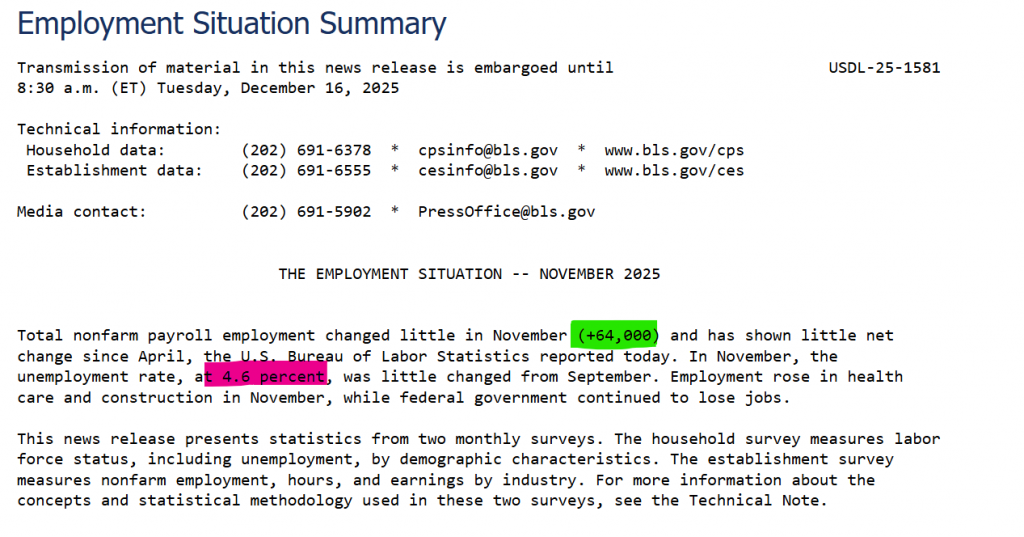

The November jobs report delivered a mixed bag that explains the volatile reaction. On one hand, nonfarm payrolls added 64,000 jobs, surpassing estimates of 50,000. This strength is typically hawkish for the Fed, suggesting less urgency for rate cuts, which is a headwind for risk assets like Bitcoin. On the other hand, the unemployment rate climbed to 4.6%, the highest since late 2021, indicating labor market softness—a dovish signal that could justify easier policy. This contradiction is why Bitcoin jerked in both directions, unsure which narrative to follow.

The Fed’s Dilemma and Market Implications

This report is the first major test since the Fed’s December rate cut. Chair Jerome Powell recently emphasized a data-dependent pause, and this jobs report does not provide a clear direction. The stronger payroll number gives Fed hawks reason to delay further cuts, while the rising jobless rate offers doves ammunition to advocate for more support. For Bitcoin, this means prolonged uncertainty. Markets hate indecision, which often leads to the kind of choppy, reactive Bitcoin price swings seen today.

Bitcoin ETF Flows

Another factor was the U.S. spot Bitcoin ETF that had a bloodiest day from nearly 3 weeks with a net outflow of $357.69M.

Looking Ahead: All Eyes on CPI Inflation Data

With the jobs picture murky, the market’s focus now intensifies on the upcoming Consumer Price Index (CPI) report on December 18. Inflation data will be the decisive tiebreaker for the Fed. A hot CPI print would likely strengthen the hawkish interpretation of the jobs report, pressuring Bitcoin. A cool reading, however, could reinforce the dovish unemployment signal and reignite the bullish macro narrative for crypto. The January FOMC meeting hinges on this clarity.

My Thoughts

Today’s volatility is a textbook example of Bitcoin’s sensitivity to macro ambiguity. The market is desperately trying to price in the Fed’s reaction function, but the data is contradictory. In the short term, this likely means continued range-bound trading and sharp reactions to headlines until a clearer trend emerges. For Bitcoin to launch a sustained breakout, it needs a unified macro narrative—either clear evidence of economic slowdown (prompting aggressive cuts) or resolute risk-on sentiment. For now, caution and nimble trading are warranted.