A new report from blockchain analytics firm Glassnode is pushing back against a popular narrative: that Bitcoin’s classic four-year cycle is broken. Despite massive institutional adoption, key metrics show this cycle is unfolding remarkably similarly to previous ones, challenging claims from prominent analysts that “the cycle is dead.”

The “Cycle Death” Narrative vs. The Data

Recently, several big names have declared the end of Bitcoin’s cyclical nature. CryptoQuant CEO Ki Young Ju pronounced it dead, and Bitwise CIO Matt Hougan argued that institutional flows have overridden the old patterns.

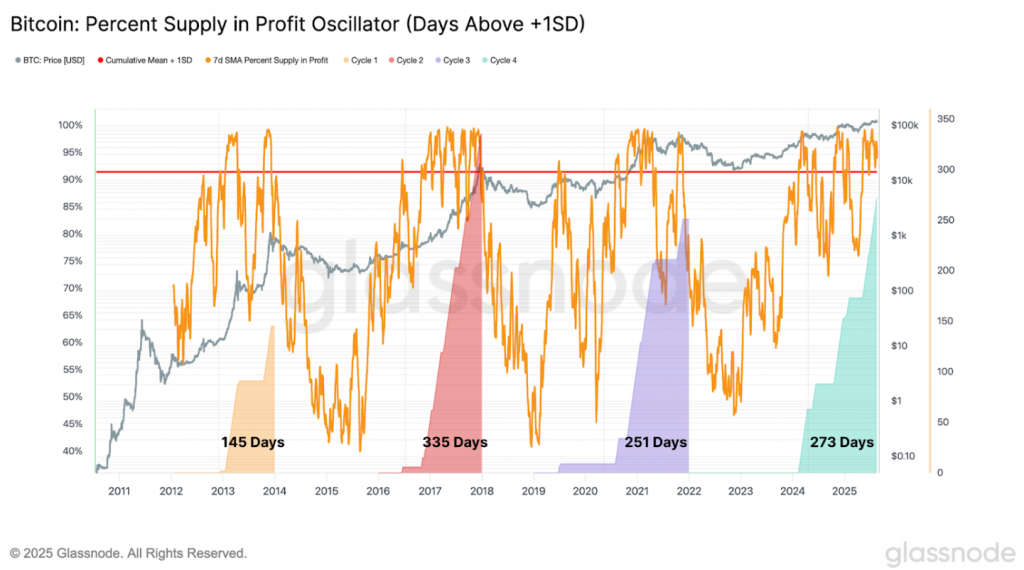

However, Glassnode’s data tells a different story. They found that Bitcoin’s current cycle duration and the behavior of long-term holders (LTHs) are closely mirroring past cycles. For instance, the supply has remained in profit for 273 days—the second-longest duration on record, just behind the 2015-2018 cycle.

Signs of a Mature Cycle: Profit-Taking and Leverage

The data reveals classic late-cycle behavior is already here:

- Profit-Taking: Long-term holders have realized massive profits, consistent with historical euphoric phases where they distribute coins to new buyers.

- Sky-High Leverage: Derivatives markets are flashing warning signs. Combined open interest for altcoins hit a record $60.2 billion before a sharp correction, and Ethereum’s futures volume dominance reached an all-time high, showing extreme altcoin speculation.

- Weaker Capital Inflows: Despite a new all-time high of $124,400, the rate of new capital flowing into Bitcoin (measured by the realized cap) is only half of what it was during the initial push to $100,000.

Institutional Adoption: A Cycle Changer?

It’s true that institutions are piling in. 297 public companies now hold over 3.67 million BTC, and Hong Kong’s Ming Shing Group just announced a $483 million purchase.

The critical question is: does this fundamentally break the cycle? Glassnode’s analysis suggests no. While the players are different (corporations vs. retail), the underlying market mechanics of profit-taking, leverage, and sentiment appear to be following a familiar script.

Technical Outlook: Key Levels to Watch

So, where does Bitcoin go from here? The recent pullback is seen by many analysts as a healthy reset after an overleveraged rally, not a fundamental breakdown.

- Key Support: The $112,000 – $110,000 zone is critical. A strong hold here could set the stage for consolidation before another push toward new highs.

- Key Resistance: A break above $124,000 could reignite momentum quickly, especially with institutional demand still strong.

The bottom line? Don’t write off Bitcoin’s cycle just yet. The stage may be set with new actors, but the play’s plot is following a very familiar arc.