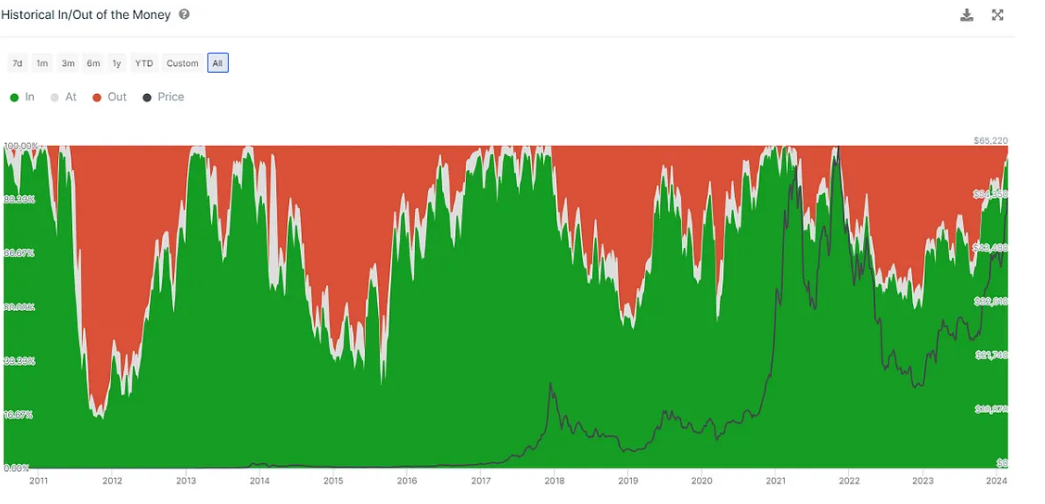

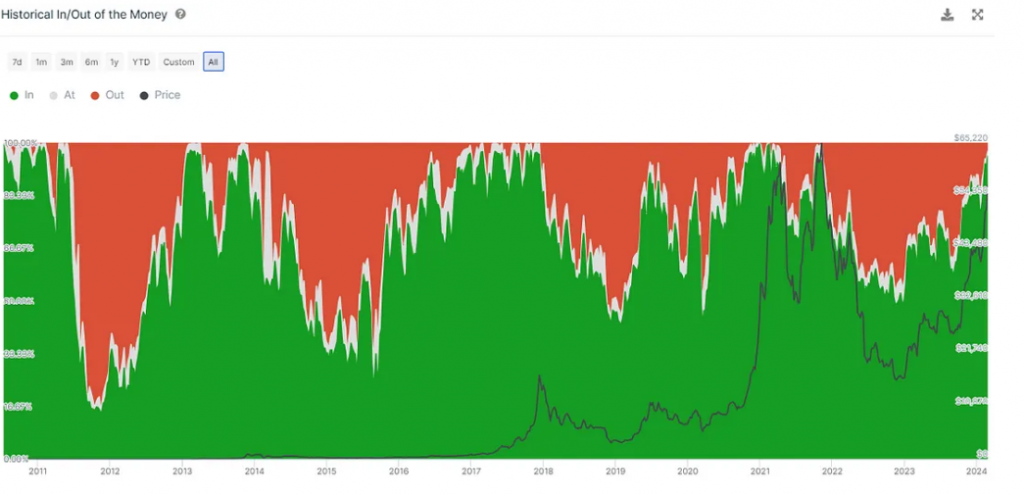

Bitcoin’s recent surge in value has left the majority of bitcoin-holding addresses in a profitable position.

According to data from analytics firm IntoTheBlock, over 97% of BTC addresses are currently “in the money,” marking the highest proportion since November 2021, when Bitcoin reached its record high of around $69,000.

Being “in the money” means that the current market price of BTC is higher than the average acquisition cost of the address. In simpler terms, most holders bought their BTC at a lower price than its current value of approximately $65,000.

This data suggests positive momentum for the market, as explained by IntoTheBlock. With a significant percentage of addresses showing profit, the pressure from users looking to sell and break even is reduced. Additionally, new market entrants purchasing coins are essentially buying from existing users who have already made a profit.

Bitcoin’s price has surged by 54% this year, building on the 154% gain seen in 2022. This growth is largely attributed to strong inflows into U.S.-based spot exchange-traded funds approved in January. The adoption of these spot ETFs by Wall Street has tilted the demand-supply dynamics in favor of buyers, setting the stage for a potential rally toward a new all-time high.