Bitcoin, the world’s largest cryptocurrency, experienced a remarkable surge of 155.9% in 2023. While much of this gain was fueled by excitement surrounding the approval of spot Bitcoin ETFs in the United States, which have now been launched, there are still compelling reasons to believe that Bitcoin’s upward trajectory may continue in the coming months.

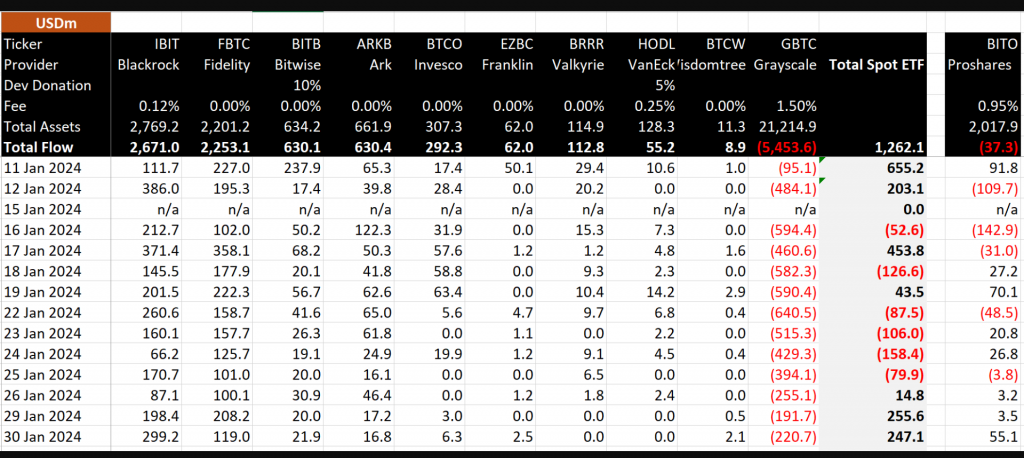

My bullish stance on this leading digital asset is anchored in several factors. Firstly, the robust demand witnessed by these ETFs suggests a strong interest in Bitcoin from both the general public and institutional investors. Despite the decline in Bitcoin’s price since the ETFs’ launch, the lower-fee funds from major asset managers like BlackRock, Fidelity, and ARK Invest are gaining significant traction. BlackRock’s iShares Bitcoin Trust has quickly amassed over $2 billion in assets under management (AUM), while Fidelity Wise Origin Bitcoin Trust is rapidly approaching the $2 billion mark.

The success of these ETFs reflects Bitcoin’s evolution into a mainstream financial asset. As these funds continue to grow and add to their Bitcoin holdings, they are likely to provide additional buying support for Bitcoin.

Moreover, there is burgeoning anticipation for the introduction of spot Bitcoin ETFs in Hong Kong, a major global financial center. The Harvest Fund and Venture Smart Financial Group are among the firms filing for approval, with expectations that up to 10 funds could launch spot Bitcoin ETFs in this influential market.

Additionally, the upcoming Bitcoin halving in April adds another layer of optimism. Occurring every four years, the halving event involves reducing the rewards for Bitcoin miners, making Bitcoin scarcer over time and potentially increasing its value. Historical data suggests that previous halving events have often preceded significant upward moves in Bitcoin’s price, with an average increase of 128%.

While the speculation surrounding the approval of spot Bitcoin ETFs has subsided, there remain plenty of catalysts to fuel optimism. The early success and demand for the new ETFs, the potential approval of additional spot Bitcoin ETFs in Hong Kong, and the upcoming halving in April collectively contribute to a bullish outlook for Bitcoin in the coming months.