The crypto market outlook for October 24 centers on a single, critical event: the release of the U.S. Consumer Price Index (CPI) report for September. This key inflation data, the first since the government shutdown, will heavily influence the Federal Reserve’s policy and set the tone for risk assets.

Bitcoin ETFs Inflows

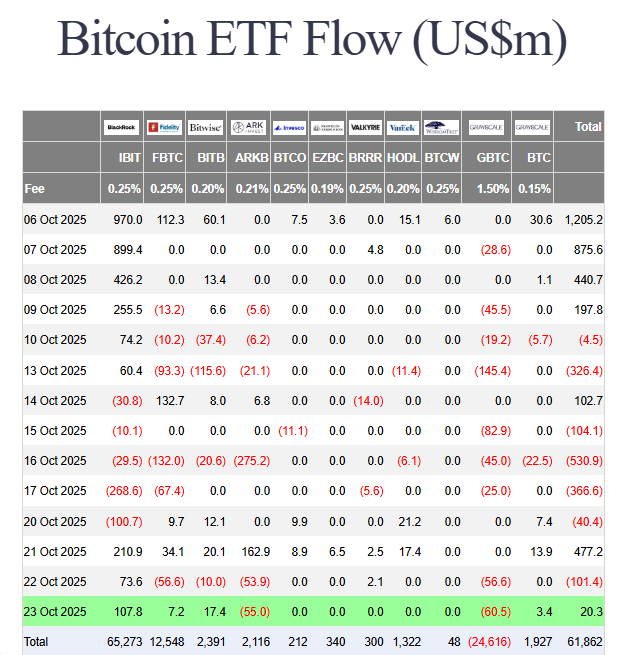

Amid this anticipation, a spot of good news emerged. Bitcoin ETFs rebounded from outflows, posting $20.3 million in net inflows on October 23. This shift in sentiment was led by BlackRock’s IBIT, which attracted $107.8 million. This break in the outflow streak provides a modest bullish counterpoint to the prevailing caution.

Bitcoin is currently trading around $111,000, benefiting from this improved institutional flow and building positive momentum. Technically, this sets up a potential test of the $115,000 resistance level if the CPI data proves favorable.

Key Takeaways

- The crypto market outlook is dominated by the upcoming US CPI report.

- Bitcoin ETFs saw a rebound with $20.3M in inflows, led by BlackRock.

- BTC trades near $111K, with growing momentum for a push to $115K.

- The market’s next major move is highly dependent on the inflation data.

My Thoughts

All roads lead to the CPI print today. A cooler-than-expected number could validate the recent ETF inflow rebound and trigger the push toward $115,000. However, a hot inflation report would likely crush this fragile recovery. The positive ETF flow is a welcome sign, but it’s a minor factor compared to the macro wave that the CPI data will unleash.