Liquidity Firehose: Fed Repo Operations Pump $22.8B as Bitcoin Rallies

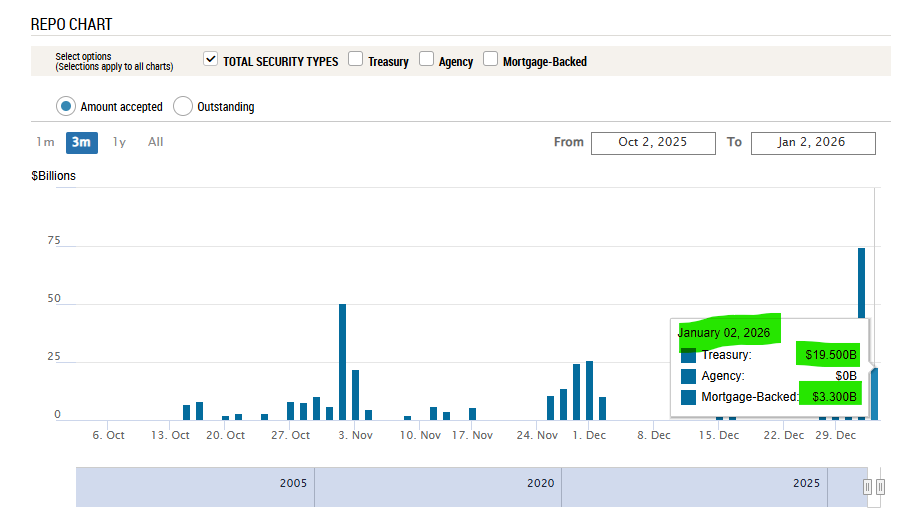

The money printer is humming again, and crypto is feeling the love. To kick off 2026, the Federal Reserve has resumed its Fed repo operations, injecting a fresh $22.8 billion in liquidity directly into the financial system. This immediate macro tailwind is providing rocket fuel for Bitcoin, which is now powering through geopolitical tensions to reclaim the crucial $90,000 level.

This latest injection follows a massive $74 billion year-end operation, confirming that liquidity is flowing back into markets. Historically, such expansions in the money supply act as a major catalyst for scarce assets like Bitcoin. Analysts are now connecting the dots: Arthur Hayes has highlighted that these Reserve Management Purchases (RMP) could spark a significant BTC rally, while other forecasts suggest a path to $170,000 if easing cycles accelerate.

Bitcoin Shows Strength Amid Geopolitical Turmoil

Remarkably, Bitcoin’s rally is unfolding even amid significant geopolitical shock. News broke of the U.S. capture of Venezuelan President Nicolás Maduro, briefly spiking uncertainty and causing a dip to $89,000. However, BTC swiftly recovered, demonstrating its growing resilience as a macro asset largely decoupled from traditional risk-off events.

This price action underscores a powerful narrative: Bitcoin is trading on liquidity, not headlines. While traditional markets often fret over geopolitical strife, crypto is increasingly focused on the raw dollar liquidity provided by ongoing Fed repo operations. This dynamic suggests that as long as liquidity conditions remain accommodative, Bitcoin’s upward trajectory has a strong fundamental driver.

My Thoughts

This is a textbook liquidity-driven move. The Fed’s actions are providing the dry powder for a sustained risk-asset rally, and Bitcoin is the prime beneficiary. The ability to shake off a major geopolitical event is exceptionally bullish; it shows institutional conviction that macro liquidity trumps all. Watch these repo operations closely—they are becoming a leading indicator for crypto market strength. If this liquidity tide continues, $90,000 will become a support floor, not a ceiling.