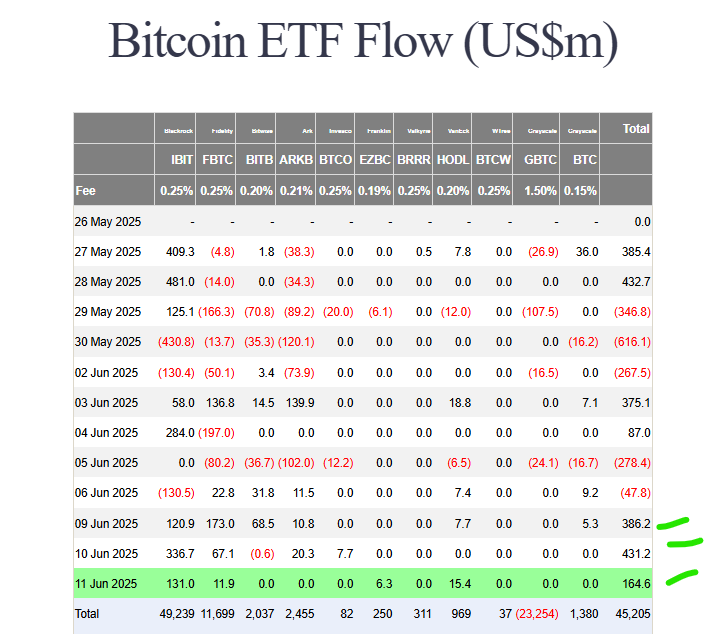

Spot Bitcoin ETFs recorded $160 million in net inflows yesterday, marking three straight days of positive movement. While this shows sustained investor interest, it’s a notable drop from the $435 million seen just a day earlier. The slowdown comes as Bitcoin’s price hovers near $110,000, struggling to break through key resistance.

Bitcoin ETF Inflows Dip but Remain Strong

On Wednesday, U.S. spot Bitcoin ETFs pulled in $165 million, down 61% from Tuesday’s $435 million. The decline suggests some hesitation as BTC’s price stalls near $110K, likely due to profit-taking.

- BlackRock’s IBIT led with $131M in inflows, pushing its total to $49.24B.

- VanEck’s HODL followed with $15.39M, nearing $1B in lifetime inflows.

Despite the slowdown, demand remains strong—indicating long-term confidence in Bitcoin’s growth.

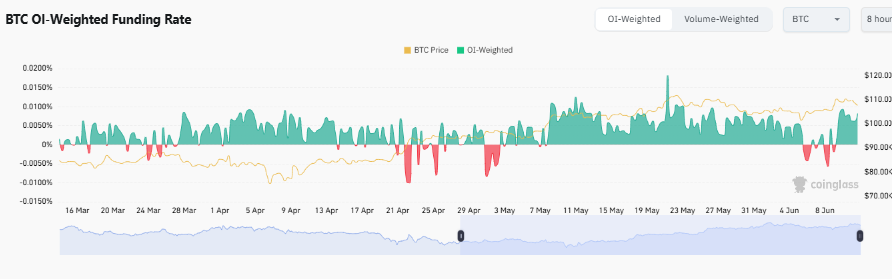

BTC Price Stalls, But Derivatives Stay Bullish

Bitcoin dipped 2% in the past 24 hours, now trading at $107,939. Yet, derivatives markets signal optimism:

- Futures funding rate remains positive (0.0062%), meaning longs outweigh shorts.

- Options traders are loading up on call contracts, betting on a near-term breakout.

A positive funding rate suggests traders expect upward momentum, even as spot prices consolidate.

What’s Next for Bitcoin?

- If BTC breaks $110K, ETF inflows could surge again, fueling a new rally.

- If resistance holds, we may see further consolidation before the next big move.

With bullish derivatives data and steady ETF demand, Bitcoin’s outlook remains strong—but the $110K breakout is key.