Saylor Pauses, But Don’t Panic: The Bitcoin Price Prediction Remains Constructive

Michael Saylor’s Strategy has temporarily halted its relentless Bitcoin buying spree, raising questions about institutional demand. However, a clear look at the charts reveals a resilient market. Our Bitcoin price prediction remains anchored to a strong technical structure, with the $85,000 support zone repeatedly proving its strength. While Saylor’s pause removes a short-term buyer, it doesn’t erase the underlying bullish framework.

Why Saylor’s Pause is a Timing Play, Not a Loss of Faith

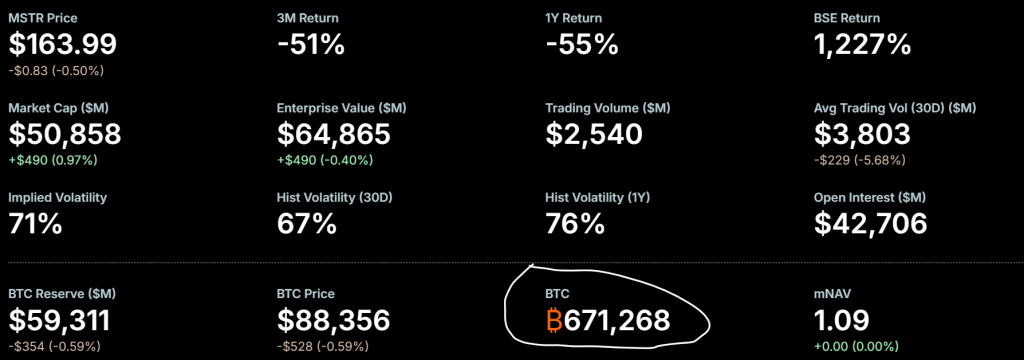

Let’s be clear: Strategy hasn’t sold a single satoshi. The company simply raised $748 million in cash, boosting its war chest to over $2.1 billion while maintaining its 671,268 BTC treasury. This is a strategic liquidity build, likely preparing for future opportunities or corporate needs. With over $41 billion in “ATM” capacity remaining for future purchases, this is a tactical pause, not a strategic retreat. The mean acquisition cost remains $74,972, a level far below current prices.

Technical Structure Trumps Speculation: $85K is the Key

The price action tells the real story. Despite the news, Bitcoin has consistently found fierce buyers near $85,000. Each test has resulted in a sharp rebound, confirming this as a major high-time-frame support zone. The market is range-bound between this floor and the $90,000-$92,000 resistance.

The DMI indicator shows a positive directional bias (+DI above -DI), while a low ADX (around 14) confirms a lack of strong trend momentum—typical of consolidation. There is simply no chart-based evidence supporting a breakdown to $74,000. The structure favors a resolution of the current range, not a catastrophic collapse.

My Take / Market Impact

This is a healthy development. Saylor’s pause allows the market to absorb demand naturally and build a stronger base. For savvy investors, this consolidation near $85K is a gift. It provides a high-conviction area to accumulate with a clear invalidation level below support. My Bitcoin price prediction remains bullish above $85K. The path of least resistance is still toward $100K, but we need a decisive close above $92K to confirm. Until then, patience and range trading rule.