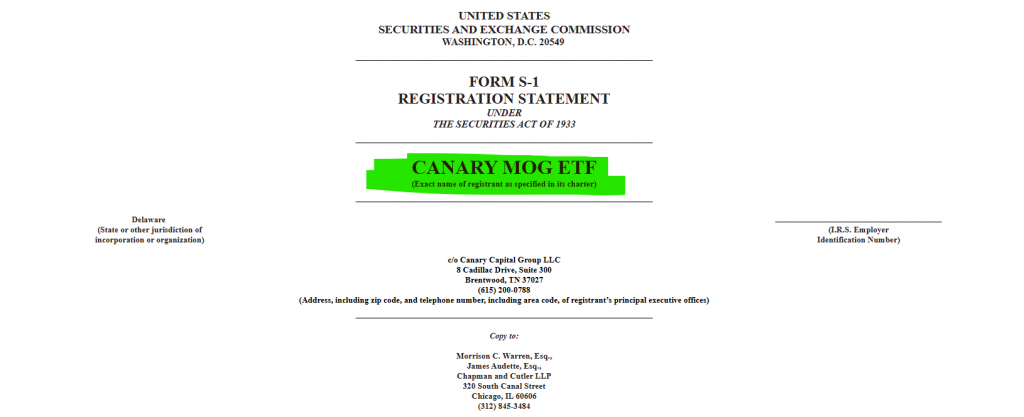

Get ready for a paradigm shift in regulated crypto investing. Canary Capital has just dropped a bombshell by filing with the SEC for the Canary MOG ETF—the first US memecoin ETF to track a pure memecoin.

Wall Street Meets Memes: Canary Files for First-Ever US Memecoin ETF

This isn’t a futures-based product; it’s a spot ETF that would hold actual Mog Coin (MOG) tokens in custody, providing investors with direct, regulated exposure to an asset defined by its social and meme-driven culture rather than traditional utility. This bold move represents the most significant attempt yet to bridge the multi-billion dollar meme economy with the trillion-dollar world of traditional finance.

Inside the Radical Memecoin ETF Proposal

The filing reveals a structure that mirrors approved Bitcoin and Ethereum spot ETFs. The Canary MOG ETF will operate as a trust, issuing and redeeming shares in large blocks backed by the underlying MOG tokens. This makes it accessible to both retail investors through their standard brokerage accounts and large institutions. Critically, the fund is filing under the Securities Act of 1933, the same framework used for other spot crypto ETFs, granting it an exemption from the stricter 1940 Investment Company Act. This strategic legal positioning was key to the successful launches of spot Bitcoin and Ethereum funds and is now being deployed for a memecoin.

The Bigger Picture: Crypto ETF Expansion Accelerates

This groundbreaking memecoin ETF filing is part of a massive institutional land grab. Canary’s own spot XRP ETF is set to begin trading on November 13, and Solana ETFs from Bitwise and Grayscale have already amassed over $500 million in assets since their October launch. Furthermore, a recent update from the U.S. Treasury (Revenue Procedure 2025-31) now provides a pathway for spot ETFs to stake their proof-of-stake assets, potentially adding 5-7% yield to funds holding tokens like SOL and ETH. The regulatory landscape is rapidly evolving to accommodate a wider array of digital assets.

What This Means for the Market and Meme Culture

The introduction of a memecoin ETF would fundamentally blur the lines between speculative internet culture and mainstream finance. It represents the ultimate validation—and potential commodification—of the meme economy. For investors, it offers a regulated, convenient way to gain exposure to a highly volatile but high-potential asset class. However, it also carries significant risks, as the value of MOG is almost entirely driven by social sentiment and community engagement, lacking the fundamental underpinnings of a smart contract platform or decentralized application ecosystem.

My Thoughts

This is a breathtakingly bold move that shows just how far the crypto ETF narrative has come. While a MOG ETF might seem absurd to traditional finance purists, it demonstrates the industry’s push for maximal inclusivity within the regulated wrapper. Its approval is far from guaranteed and will be a major test of the SEC’s tolerance. If it passes, it could open the floodgates for other meme-based products, further merging crypto-native culture with Wall Street’s capital. This is a story about boundaries being pushed, and everyone should be watching closely.