Dogecoin Price Rebound Signals Potential Trend Reversal

A notable Dogecoin price rebound is underway, with DOGE climbing 5% to reclaim ground above the critical $0.15 level. This recovery, part of a 10% two-day surge, is fueled by a mix of technical strength and a significant fundamental catalyst: renewed progress toward a U.S. spot ETF. The question now is whether this marks the start of a sustained bullish reversal.

ETF Catalyst: 21Shares Amends Key Filing

The fundamental driver is a major step toward institutional adoption. Asset manager 21Shares has submitted a fifth amended S-1 filing for its spot Dogecoin ETF, detailing a 0.50% management fee to be paid weekly in DOGE. The filing is now in the final administrative step before becoming effective, indicating the launch process is advancing. The proposed ETF (ticker: TDOG) would trade on Nasdaq, providing a massive new gateway for regulated capital.

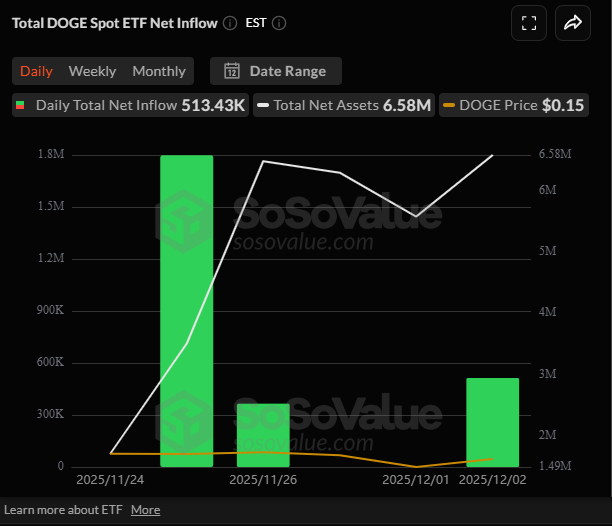

We should highlight that Dogecoin ETF recorded on December the 2nd $513,43K of positive net inflow which brings the total net assets to $6,58M after a week from the Launch.

Technical Pattern Hints at Imminent Breakout

The charts are aligning for a potential explosive move. Analysts highlight that DOGE has formed a clear Falling Wedge pattern on the daily timeframe. This is a classic bullish reversal structure where price converges between descending support and resistance lines. A breakout above the wedge’s upper trendline, accompanied by rising volume, could signal the start of a powerful new uptrend, confirming the current Dogecoin price rebound.

Key Levels: Path to $0.20 or Risk of Pullback?

With the price at $0.1524, immediate resistance sits at $0.16, followed by $0.18. A decisive break above these barriers could open a clear path toward the $0.20 target. The technical indicators support the bullish case: the RSI at 64.64 shows room for upward momentum, and the MACD has completed a bullish crossover, with green histogram bars expanding.

However, failure to hold above $0.15 could see a retest of lower support between $0.13 and $0.14. The market’s next move will depend on whether buyers can sustain momentum off this key level.

My Thoughts

This is more than a meme coin pump. The concurrent technical setup and tangible ETF progress create a compelling bullish thesis. The falling wedge is a high-probability reversal pattern, and its resolution coincides with a real-world adoption milestone. The ETF’s unique fee structure—paid in DOGE—could create consistent buy-side pressure. If the wedge breaks upward, a swift move toward $0.20 is highly likely.