Market Braces for Massive $2.2B Crypto Options Expiry

Get ready for potential volatility. A whopping $2.2 billion in crypto options expiry today, creating a pivotal moment for Bitcoin, Ethereum, XRP, and Solana. With thin liquidity amplifying moves, all eyes are on the “max pain” prices—the level that causes maximum losses for option holders and often acts as a magnetic price target. Let’s break down the levels that could dictate next week’s trend.

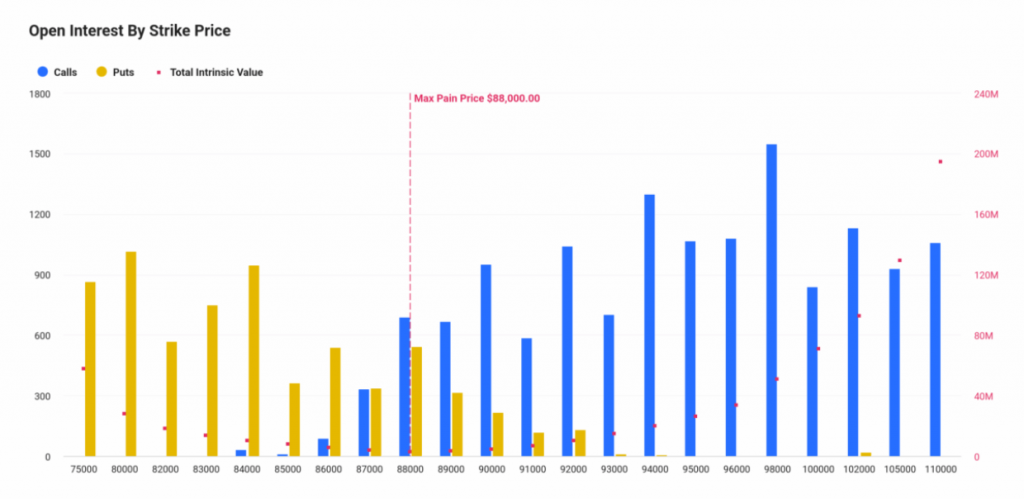

Leading the pack, 21,000 Bitcoin options ($1.85B notional) are set to expire. The put-call ratio of 0.48 shows a bullish bias among traders. The max pain price sits at $88,000, just below BTC’s current spot price. Heavy put (sell) positions cluster between $80K-$87K, suggesting strong support, while calls (buys) dominate above $89K. This sets up a clear battleground; a hold above $88K could trigger a grind toward $90K.

Ethereum, XRP, and Solana Face Their Own Tests

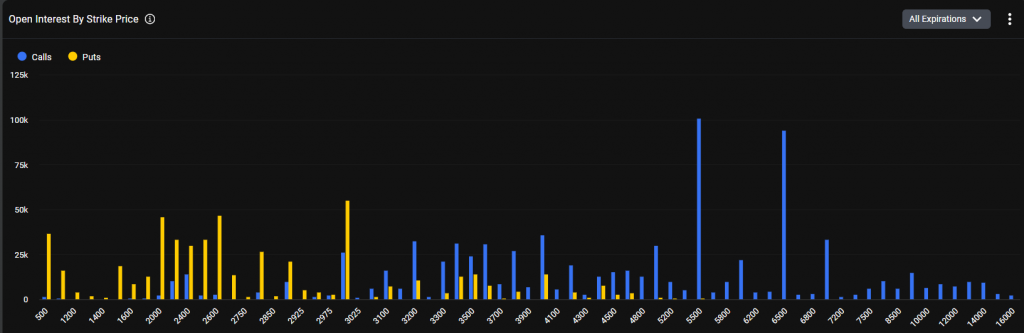

The crypto options expiry event also features 129K ETH contracts ($400M). Here, the put-call ratio is 0.62, signaling even stronger bullish sentiment. Ethereum’s max pain is at $2,950. With ETH currently above $3,000, holding this level is crucial for bulls to maintain momentum and target a breakout.

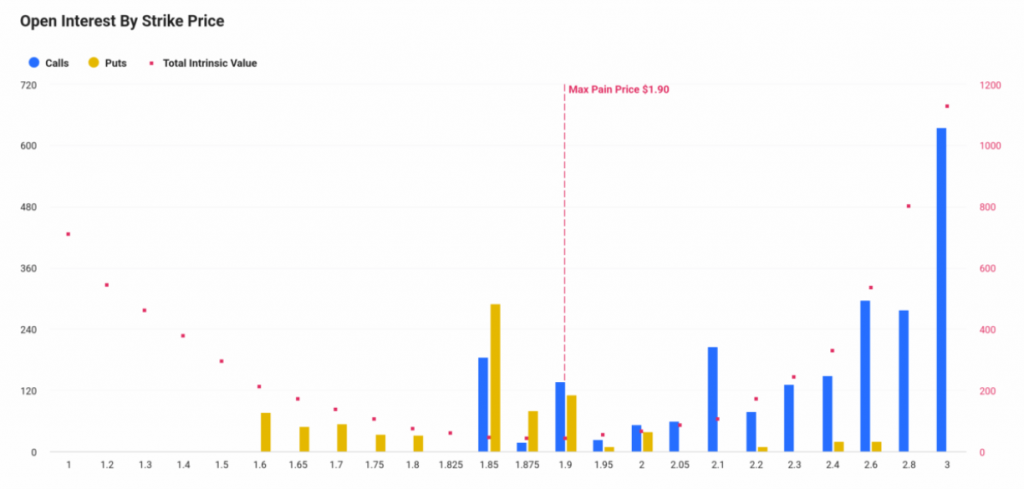

For XRP, the max pain is $1.90, aligning closely with its current price. A bullish TD Sequential buy signal on its bi-weekly chart could support a rebound. Meanwhile, Solana faces a test at $124. Despite a positive price move, increased put volume suggests traders might target this max pain level in the short term.

My Thoughts

This expiry is a critical stress test for market conviction. The predominantly low put-call ratios reveal that traders are net-long, using puts mainly as hedging insurance. If prices hold above max pain levels, it could flush out weak bears and fuel a January rally. However, failure to hold could see prices snap toward those clustered strike prices. Watch BTC’s reaction at $88K as the leading indicator for the rest of the market.