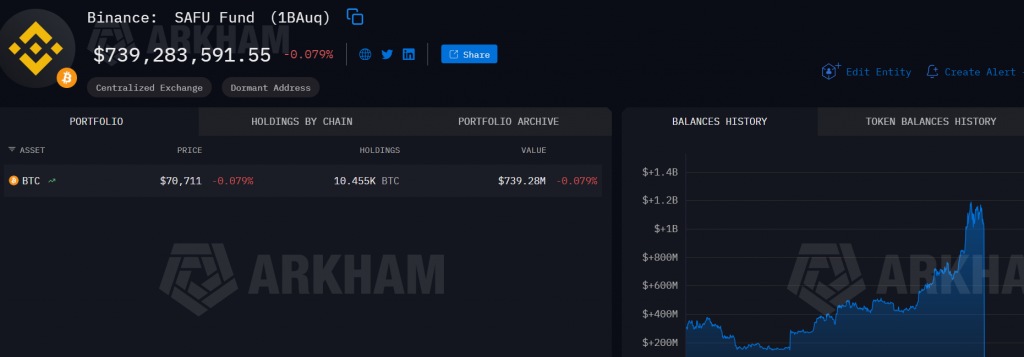

The world’s largest crypto exchange is making a monumental, conviction-driven bet. Binance has added another $300 million in Bitcoin to its emergency SAFU fund, accelerating its historic shift away from stablecoins. This latest purchase of 4,225 BTC brings the fund’s total Bitcoin holdings to over $720 million, showcasing a breathtakingly bullish Bitcoin accumulation strategy even as market sentiment crumbles.

Binance’s Bold Bitcoin Accumulation Strategy

In late January, Binance announced a plan to convert its entire $1 billion Secure Asset Fund for Users (SAFU) into Bitcoin. This week’s $300 million buy is a major step toward that goal, with the exchange stating it aims to complete the conversion within 30 days of the original announcement. This move fundamentally rebases the fund that protects users from extreme incidents onto Bitcoin’s balance sheet, signaling an unmatched belief in BTC as the ultimate reserve asset.

However, this strategy is not without risk. It exposes the emergency fund to Bitcoin’s notorious volatility. Binance has a safeguard: it will rebalance the fund back to $1 billion if its value drops below $800 million. This creates a built-in, massive buy order for BTC on severe dips.

Market Context: Accumulation Amid Extreme Fear

This aggressive accumulation is happening against a bleak backdrop. Bitcoin recently crashed to $59,930, a level not seen since October 2024. Sentiment is “very fragile,” according to analysts, with many traders anchored to a fearful “boom and bust” cycle narrative.

Notably, this bold move contrasts sharply with the actions of “smart money.” Data from Nansen shows that top traders are net short Bitcoin by $109 million, betting on further decline. Binance is effectively buying while the smartest traders are selling—a powerful contrary signal.

My Thoughts

This is a legendary display of conviction over sentiment. While the market panics, Binance is executing a billion-dollar Bitcoin accumulation strategy for its most critical fund. This does two things: it provides a huge, transparent bid on the market, and it signals to the entire industry that Bitcoin is the only asset reliable enough to backstop user safety. The contrast with net-short smart money is the clearest alpha signal you’ll get. It highlights that true long-term players are building, while short-term traders are hunting for scraps. This is profoundly bullish for the cycle’s structure