Bitcoin Market Crossroads: Bear Market Data vs. Contrarian Hope

As the year winds down, Bitcoin is trapped in a tense stalemate. The market stands at a critical crossroads, pulled between undeniable bearish on-chain signals and a contrarian setup ripe for a surprise rally. With price compressed below $90,000, gold hitting record highs, and institutional selling persistent, the path forward is fiercely contested. Let’s navigate the conflicting data to find the real signal in the noise.

The Heavyweight Bearish Evidence

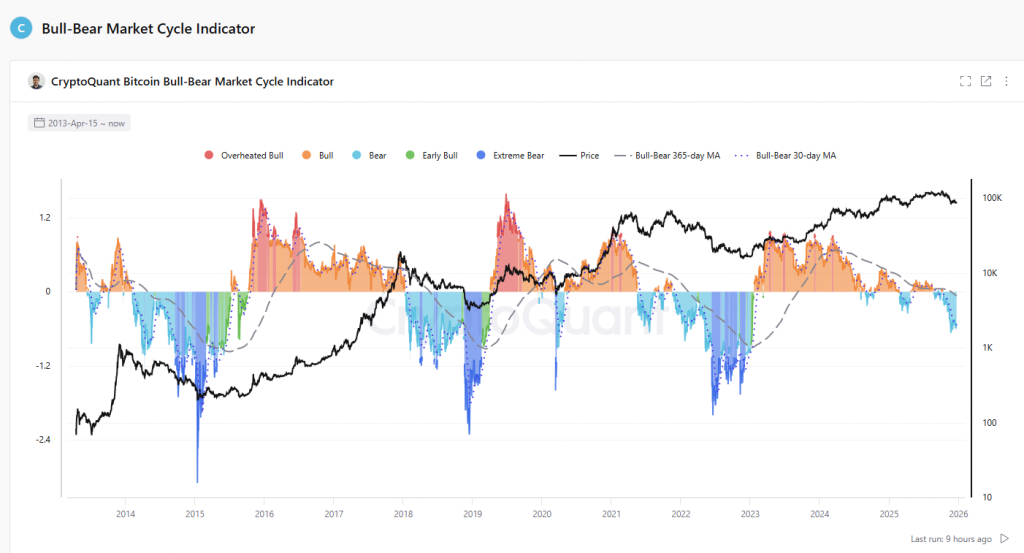

Multiple respected metrics paint a defensive picture. CryptoQuant’s Bull-Bear Market Cycle Indicator has been negative since September, recently hitting lows not seen since the 2022 bear market. This suggests the market structure has fundamentally shifted.

This is compounded by a negative Coinbase Premium, indicating persistent selling pressure from U.S. investors, and reduced network activity. Technically, the failure to reclaim the yearly open near $93,500 keeps bulls on the back foot. Some analysts warn that losing $80,000 could open a path down to $72,000, or even $60,000 in a severe scenario.

The Case for a Contrarian Rally

Yet, extreme pessimism itself can be a fuel source. The Crypto Fear & Greed Index languishes at 25/100—”Extreme Fear.” Historically, such sentiment extremes have preceded powerful counter-trend rallies.

Furthermore, data suggests the bulk of institutional selling from the $126K top may be exhausted. Analyst CrypNuevo notes, “there probably isn’t much left to sell right now.” This could set the stage for a aggressive pump into year-end, especially if price can reclaim the 50-day EMA (~$93.5K) and target $100,000.

Macro Shadows and the Precious Metals Flight

The backdrop adds complexity. Japanese bond yields spiking to record highs create global uncertainty, traditionally a risk-off trigger. Meanwhile, gold and silver are making record runs as safe-haven assets, highlighting a capital rotation away from risk—a narrative Bitcoin has yet to break.

My Take / Market Impact

This is the ultimate Bitcoin market crossroads. The bearish on-chain data is too significant to ignore; it tells us we are in a corrective phase, not a bull run. However, markets often bottom on despair. The extreme fear and potential for a short squeeze make a violent move above $93.5K plausible. My base case is continued range-bound action between $80K-$93K until a macro catalyst (like a Fed pivot) provides direction. The trade here is patience. Wait for a decisive break of the range with volume before committing.