While retail investors panicked during Monday’s market drop, one major player saw a golden opportunity. Blockchain firm BitMine buys ETH aggressively during the decline, purchasing 63,539 Ether worth $251 million as the price fell below $4,000. This massive accumulation continues the company’s strategy to build one of the world’s largest corporate Ethereum treasuries.

BitMine Buys ETH $251 million of it

The decision for BitMine buys ETH during weakness aligns with chairman Tom Lee’s public view that this pullback represents a strategic “buying opportunity.” Under his leadership, the company now holds an astonishing 3.29 million ETH, worth over $13 billion. This represents 2.73% of all Ethereum in existence, putting them closer to their ambitious goal of controlling 5% of the total supply.

Analysts See Rebound Ahead

Despite the worrying price action, several prominent analysts are turning bullish on Ethereum’s short-term prospects. Crypto expert Ali Martinez, who accurately predicted the recent pullback, now forecasts a rebound toward $4,440. He points to Ethereum bouncing from the lower boundary of a technical pattern that has contained its price since August.

Another trader, Merlijn, compared Ethereum’s current setup to gold’s chart right before its massive breakout earlier this year. The analysis suggests Ethereum could be on the verge of its own explosive move toward five-digit prices, potentially reaching $10,000.

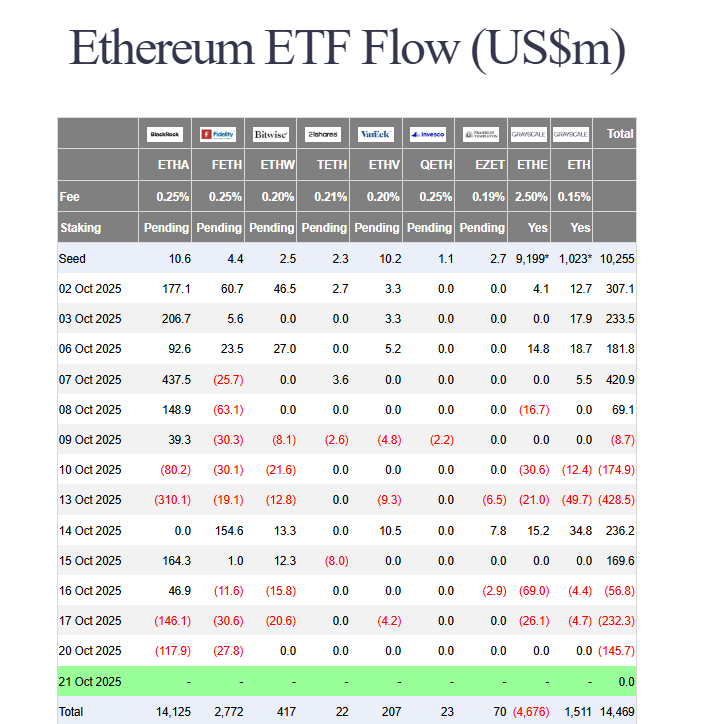

These optimistic projections come despite ongoing outflows from spot Ethereum ETFs, which saw $145 million leave the funds recently. The divergence between institutional accumulation and ETF flows highlights the complex forces currently affecting Ethereum’s price.

My Thoughts

When a firm that already holds $13 billion in Ethereum continues buying during dips, it’s a powerful signal. They’re not just talking about believing in Ethereum—they’re putting another quarter-billion dollars behind that belief. The combination of institutional accumulation and positive technical analysis suggests this drop may be more of a pause than a reversal. If Bitcoin stabilizes, Ethereum could lead the next leg up.