The institutional whales are making waves again! In a bold move that’s shaking up the crypto markets, BitMine has executed a massive BitMine Ethereum purchase, acquiring 7,660 ETH worth approximately $29 million from Galaxy Digital.

BitMine Ethereum Purchase : A $29M Bet on ETH

This isn’t just a random trade; it’s a strategic accumulation that highlights a growing divide between institutional confidence and retail caution. As Ethereum price hovers around $3,780, down 1.2% in the past 24 hours, the smart money is betting big on a reversal.

Institutions Accumulate as Retail Fears

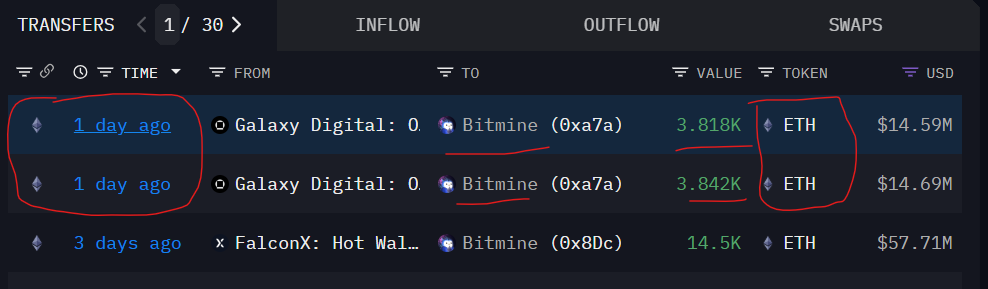

Diving into the on-chain data, we see a clear pattern of institutional accumulation. BitMine Ethereum Purchase , the latest transaction According to Arkham involved two batches of 3,818 and 3,842 ETH sent to its primary wallet. This follows a series of large-scale purchases, including over $820 million in ETH recently. Why does this matter? Because when whales like BitMine buy, it often leads to a shortage of ETH on exchanges, squeezing the supply and potentially driving prices higher. On the flip side, retail sentiment is bearish. Prediction platform Kalshi shows traders assign only a 34% probability of ETH reaching $5,000 by year-end, down from 40% a month ago. This skepticism stems from macroeconomic uncertainties and Fed Chair Jerome Powell’s comments ruling out further rate cuts this year. But history shows that when retail pulls back, whales accumulate, setting the stage for the next leg up.

Analysts Bullish on ETH Price Reversal

Despite the gloomy retail outlook, top analysts are overwhelmingly bullish. Market analyst Ted Pillows points out that BitMine has been buying $200-$300 million worth of ETH every week. He emphasized, “a few more buyers like that, and an ETH reversal could happen.” Meanwhile, renowned crypto analyst Michaël van de Poppe sees Ethereum’s ecosystem as one of the strongest investment themes for 2026. He predicts ETH could break above $5,000 once momentum builds in layer-2 networks and the Fusaka upgrade rolls out. These optimistic forecasts contrast with short-term price action, suggesting that the current dip is a golden opportunity for accumulation before the rally.

My Thoughts

In my view, this is a classic case of “be greedy when others are fearful.” The institutional buying from BitMine and others is a strong signal that Ethereum’s fundamentals are intact. The divergence between whale accumulation and retail fear often precedes significant price movements. With Ethereum’s ongoing developments and institutional interest, I believe ETH is poised for a run to new all-time highs. Don’t miss out on this dip!