Tom Lee’s Ethereum treasury company is buying the dip with relentless conviction. The latest BitMine Ethereum purchase adds another 17,722 ETH, worth approximately $34.74 million, according to on-chain data from Lookonchain. This isn’t an isolated buy—it’s part of a coordinated accumulation spree that’s rapidly accelerating.

Breaking Down the BitMine Ethereum Purchase Spree

Lookonchain identified three wallets apparently linked to BitMine that have accumulated 62,722 ETH ( $123.25 million) this week alone. This follows last week’s massive 45,759 ETH purchase—the largest of 2026—and a subsequent 20,000 ETH buy on February 19.

Total Ethereum holdings now stand at 4,371,497 ETH, worth approximately $8.5 billion at current prices near $1,962.

Closing In on the 5% Milestone

BitMine is pursuing what it calls the “Alchemy of 5%” strategy—accumulating 5% of all Ethereum in circulation. With Ethereum’s total supply at roughly 120 million, the company now holds approximately 3.3% of all ETH. That’s 72.3% of the way to its 5% target.

If this pace continues, the milestone could be reached within months—a feat that would make BitMine the single largest known Ethereum whale, surpassing even the largest exchange wallets.

BMNR Stock: Accumulation Doesn’t Guarantee Price

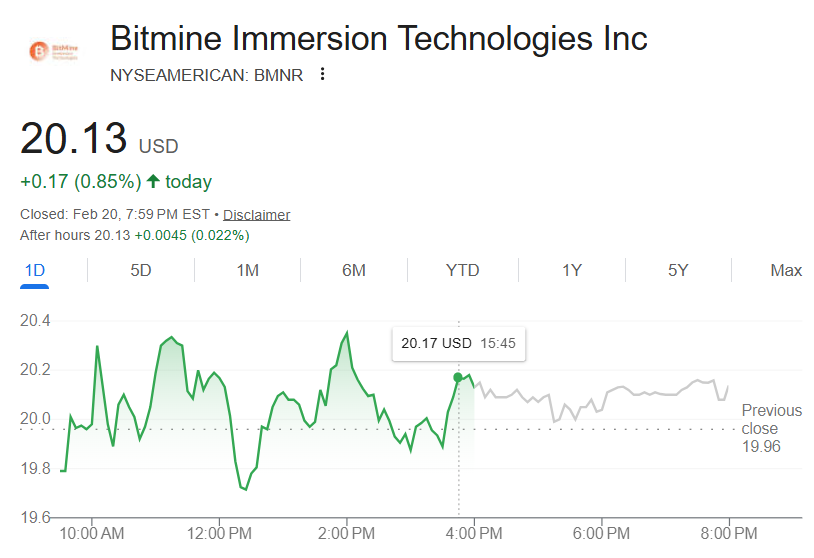

Despite the aggressive buying, BMNR stock remains under pressure. Shares traded at $20.13 in the latest session, up just 0.85%, after touching a low of $19.66. The stock is down 80% from its all-time high, reflecting the brutal reality of Ethereum’s 60% drawdown from its $4,800 peak.

My Thoughts

This is the most aggressive Ethereum whale accumulation I’ve ever documented. The BitMine Ethereum purchase spree is now approaching half a billion dollars in buys over a few weeks, all while ETH price languishes near two-year lows.

The math is simple: BitMine is treating sub-$2,000 ETH as a once-in-a-cycle opportunity. They’re not waiting for a bottom; they’re buying size at every level. This is what conviction looks like when it’s backed by billions.

For retail investors, this is a mirror test. Are you buying when Tom Lee buys, or waiting for “confirmation” that never comes? BitMine is now 3.3% of all Ethereum. They’re not a trader; they’re a sovereign-scale accumulator.

The 5% milestone will be psychological. When a single entity controls 1 in every 20 ETH, the market dynamics shift. Supply scarcity becomes real, not theoretical.