Institutional Conviction on Display: Bitmine’s Monumental Ethereum Staking Move

The largest Ethereum treasury company on the planet is putting its massive stack to work. Bitmine Immersion has initiated its first major Ethereum staking play, depositing a staggering 74,880 ETH—worth approximately $219 million—into the Proof-of-Stake network. This bold move signals profound long-term confidence and a strategic pivot to generate yield, directly countering the billions in unrealized losses on its 4-million-ETH balance sheet. Get ready—this is how institutions build generational wealth in crypto.

Bitmine’s Bold Ethereum Staking Strategy

Faced with reported unrealized losses between $3.5-$4.2 billion, Bitmine isn’t selling; it’s doubling down. By embracing Ethereum staking, the company transforms its dormant holdings into a powerful revenue engine. With a current staking APY around 3.2%, this initial deposit could generate an estimated $371 million in annual yield.

This isn’t a random test; it’s a calculated deployment following the November announcement of its “Made in America Validator Network” (MAVAN). The goal is clear: offset paper losses with real, recurring income while further securing the Ethereum network.

The Bigger Picture: A Long-Term Accumulation Game

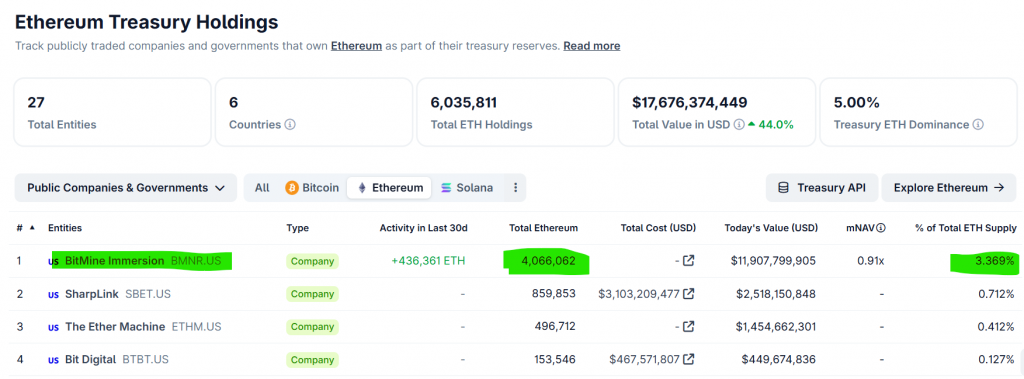

Bitmine’s Ethereum staking move is just one piece of a grander strategy. While other large holders were forced to sell, Bitmine has been aggressively accumulating, recently buying $199.4 million worth of ETH in a single day. The company now holds roughly 3.4% of Ethereum’s total supply, steadily approaching its public target of 5%.

This relentless accumulation, followed by strategic staking, reveals a blueprint: accumulate during weakness, stake for yield, and wait for the network’s fundamental value to reflect in the price. It’s a masterclass in institutional patience and conviction.

My Thoughts

This is one of the most bullish signals for Ethereum you’ll see. When the world’s largest ETH holder chooses to stake—not sell—amid massive unrealized losses, it screams long-term conviction. This action does three powerful things: 1) It removes sell-side pressure, 2) It locks up supply, increasing scarcity, and 3) It showcases a viable yield model for other institutions. Bitmine is leading by example. For retail, this is a strong hint: if they’re not selling, you shouldn’t either. This staking move lays the groundwork for the next bull leg.