The market downturn has escalated into a full-scale crypto crash, with Bitcoin plunging below $104,000 and Ethereum collapsing under $3,600. This sharp decline wiped over 5% from the total crypto market cap, erasing $830 billion in just one week. The sell-off triggered a massive $1.2 billion in liquidations, hitting long traders particularly hard.

What’s Driving the Crypto Crash?

Several powerful factors combined to trigger this crypto crash. The panic started with renewed banking fears after Western Alliance and Zions Bank reported major fraud-related loan issues. This sparked concerns about crypto off-ramps and broader financial stability.

Meanwhile, the “Trump Insider Whale” perfectly timed the market again, opening a $127 million Bitcoin short position right before key announcements. Although Trump didn’t mention new tariffs, the damage was done. This whale has now made over $200 million profit from perfectly timed shorts during recent volatility.

The pressure intensified as spot Bitcoin ETFs saw their largest single-day outflow since August—a stunning $536 million with zero funds seeing inflows. This institutional retreat created a powerful selling wave that overwhelmed the market.

Liquidation Carnage and What Comes Next

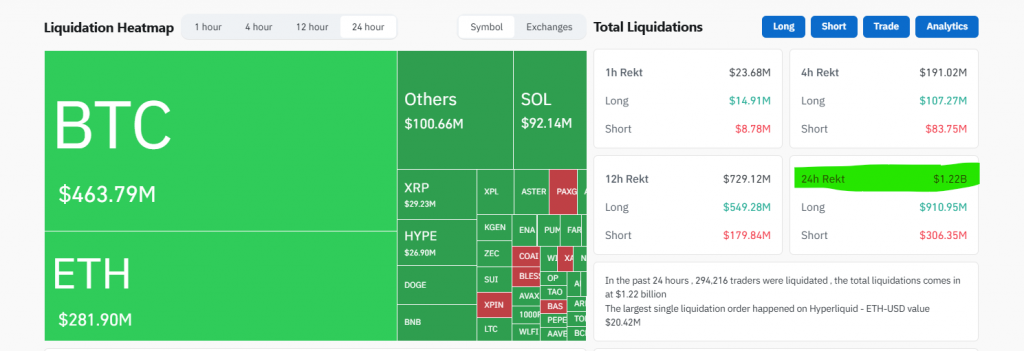

The numbers are brutal. Over 308,000 traders were liquidated in 24 hours, with long positions bearing the brunt of the pain. Bitcoin longs lost $331 million while Ethereum longs saw $198 million wiped out.

Today brings another major test: $5.7 billion in Bitcoin and Ethereum options are set to expire. With a high put-call ratio, traders are positioned for more downside, suggesting the volatility isn’t over yet.

The critical question is whether support will hold at current levels. If Bitcoin breaks below $103,900, analysts warn we could see a move toward $100,000. For Ethereum, holding $3,600 is crucial to prevent another leg down.

My Thoughts

This looks like a perfect storm of institutional profit-taking and macro fears. The banking issues created the initial fear, then the ETF outflows and whale shorting amplified the move. Until we get clarity on banking stability and the US-China trade situation, the path of least resistance remains downward. The key will be whether these levels attract enough buyers to form a bottom.