Crypto ETF flows flash early alpha

This week’s crypto ETF flows tell a clear story: institutions are still allocating, even when headlines look shaky. While Bitcoin ETFs saw a notable one-day outflow, the bigger picture remains bullish. Capital is rotating, not exiting. For traders and long-term holders alike, this is classic smart-money behavior.

Bitcoin ETFs: short-term shakeout, weekly strength

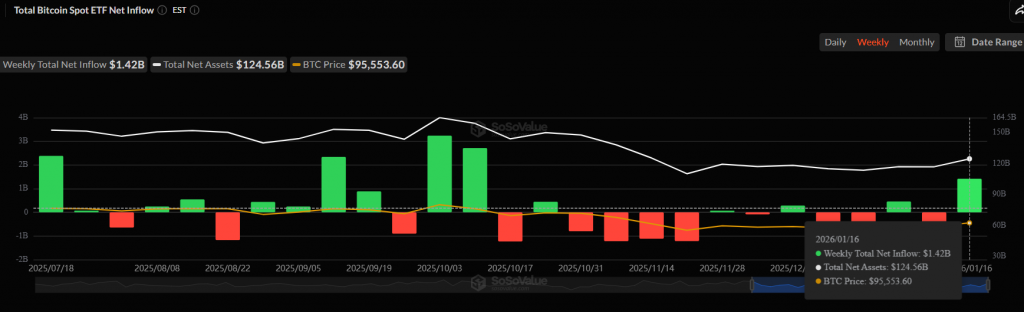

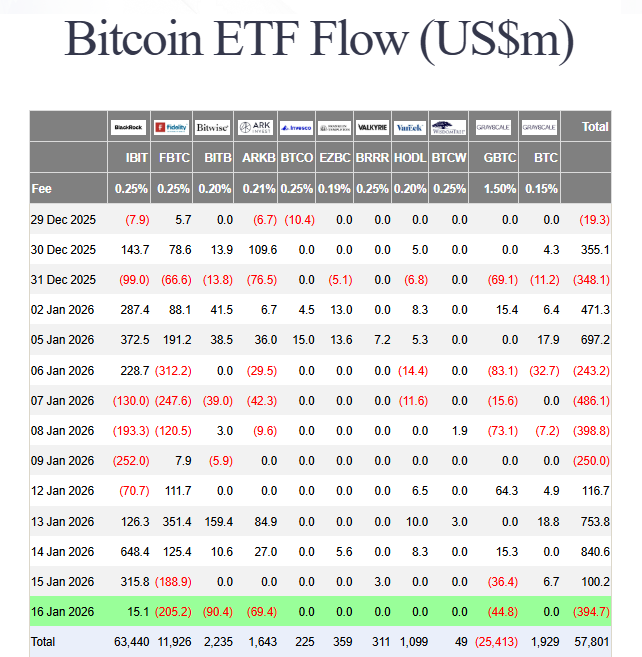

Bitcoin ETFs recorded a $394.7 million net outflow on January 16, which initially spooked markets. However, zoom out. On a weekly basis, Bitcoin ETFs are back in the green with $1.42 billion in net inflows. That’s the signal that matters.

Even more bullish, BlackRock posted positive inflows for the fourth straight day. When the world’s largest asset manager keeps buying, it suggests institutional conviction hasn’t faded. This looks like profit-taking, not distribution.

Ethereum ETFs dominate the leaderboard

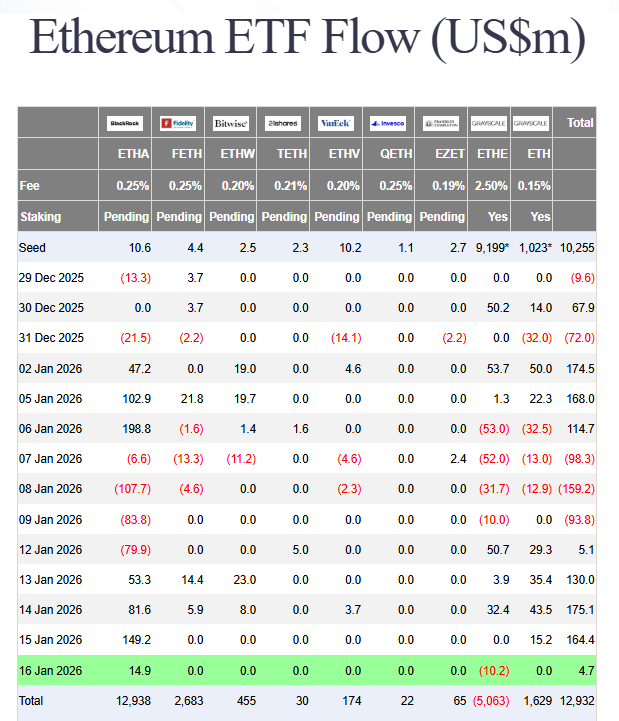

Ethereum stole the spotlight. ETH ETFs posted a perfect week, pulling in $479.04 million in net inflows — the strongest performance since their launch week in October. Again, BlackRock led the charge with four consecutive days of inflows.

Meanwhile, ETH price held firm above $2,550, confirming that demand is translating into price support. For beginners: ETFs bring traditional capital on-chain exposure, and ETH is clearly winning that race right now.

Solana ETFs cool off, but trend stays intact

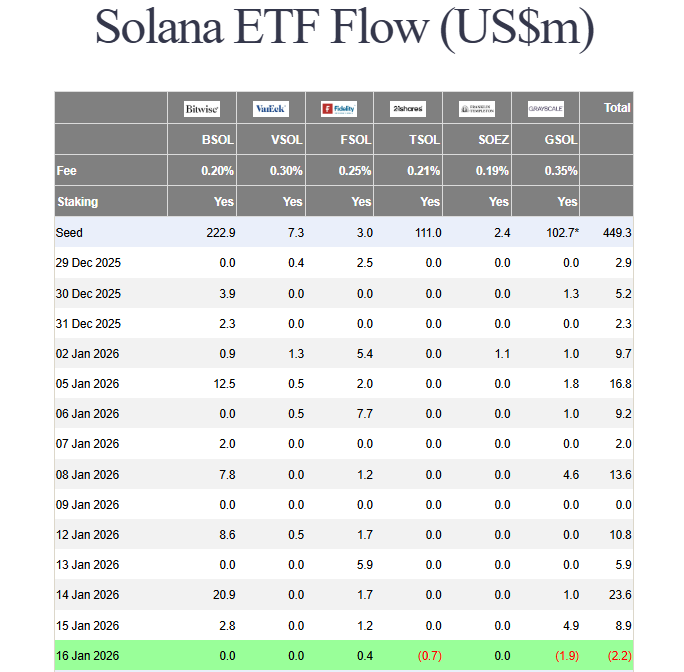

Solana ETFs saw their first daily outflow since early December, shedding $2.2 million. Still, the weekly data tells a different story. SOL ETFs ended the week with $46.88 million in net inflows. That’s consolidation, not collapse.

XRP ETFs quietly build momentum

XRP ETFs logged $1.12 million in inflows on January 16, pushing weekly totals to $56.83 million. XRP price has stayed above $2 for over two weeks, showing steady accumulation rather than hype-driven spikes.

Key Takeaways:

Crypto ETF flowsremain net positive despite short-term BTC outflows.- Ethereum ETFs posted their strongest week since launch.

- BlackRock continues accumulating across BTC and ETH.

- Solana sees healthy consolidation after strong inflows.

- XRP ETFs show quiet but consistent accumulation.

My Thoughts

This is rotation season. Capital is shifting between majors, not leaving crypto. Strong crypto ETF flows, especially into ETH, signal growing institutional confidence. These conditions often precede the next expansion leg.