The blood is in the streets. A severe risk-off sentiment has gripped digital assets, triggering a broad-based crypto market crash on November 3rd.

Crypto Market Crash Intensifies as Fed Fears Spark Liquidation Cascade

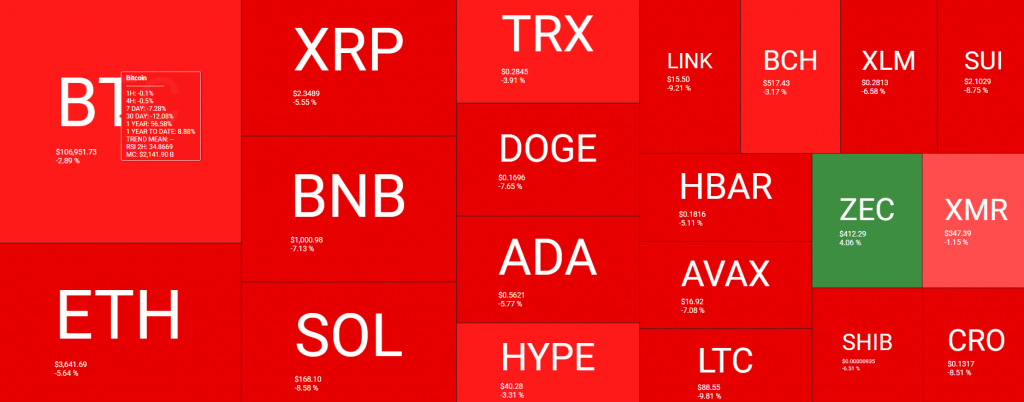

Bitcoin price cratered to $106,000, teetering on the edge of a technical bear market, while major altcoins were absolutely eviscerated with losses exceeding 15%. This brutal sell-off was ignited by a hawkish pivot from Federal Reserve officials, who are now signaling that the battle against inflation is far from over. The era of easy monetary policy appears to be on pause, and crypto is feeling the pain.

The Hawkish Fed: The Root of the Crypto Market Crash

Let’s be clear: this crypto market crash is a macro-driven event. The initial sell-off began after the Fed’s last meeting, where Jerome Powell dashed hopes for a December rate cut. Since then, the probability of a cut has collapsed from 96% to just 67%. The situation worsened when Chicago Fed President Austan Goolsbee stated he is “nervous about the inflation side,” noting it has been above target for four and a half years. This hawkish rhetoric, combined with a contracting US manufacturing sector, created a perfect storm of fear, pushing investors to flee risk assets like crypto en masse.

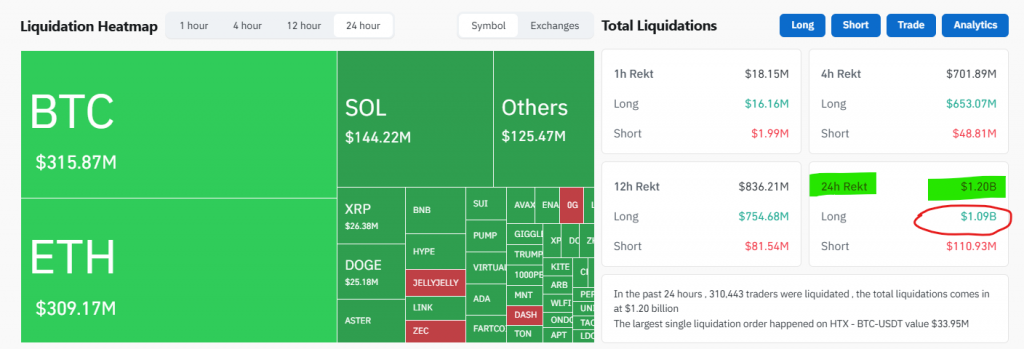

We already crossed $1B in just Long liquidation in the last 24 hrs and $1.20B in total liquidation .

Technical Breakdown: Bitcoin’s Ominous Charts

The technical picture for Bitcoin has turned undeniably bearish. The dreaded “death cross” is now near on the daily chart, with the 50-day moving average crossing below the 200-day. This classic bearish signal is often followed by further downside. Furthermore, Bitcoin is breaking key support levels, including the 38.2% Fibonacci retracement and critical Murrey Math Lines. Analysts are now warning that a drop below the psychological $100,000 level is a distinct possibility. If Bitcoin breaks, altcoins—which are already bleeding out—will likely experience an even more violent capitulation.

What Comes Next? Navigating the Downturn

For traders, the path of least resistance is now downward. The confluence of negative macro news and broken technical supports creates a highly risky environment. The key for Bitcoin bulls is to defend the $100,000 level at all costs; a loss here could trigger a waterfall of selling. Conversely, any sign of a dovish shift from the Fed or a reclaim of the $111,000 resistance level would be the first signal that a bottom might be forming. Until then, capital preservation is the name of the game.

My Thoughts

This is a painful but necessary reset. The market had become over-leveraged and overly optimistic about the Fed’s pacing. While the short-term outlook is bleak, this flush of leverage and weak hands creates a healthier foundation for the next leg up in the long-term bull cycle. For those with dry powder, this panic could present generational buying opportunities—but be patient and wait for the technical structure to show signs of stabilization first.