Rocket Fuel: Explosive Crypto Market Rally Ignited by Macro Shift

The dam has broken! An explosive, broad-based crypto market rally is underway, catapulting Bitcoin above $96,000 and Ethereum by over 7% in 24 hours. This powerful surge wasn’t driven by crypto news—it was ignited by a seismic shift in the macro landscape. Cooling U.S. inflation data and sudden political uncertainty surrounding the Federal Reserve have sent investors sprinting into scarce, non-sovereign assets like cryptocurrency.

The catalyst was two-fold. First, December’s inflation print came in softer than expected, reinforcing the narrative that the Fed can and will continue cutting interest rates in 2026. Second, reports that the U.S. Justice Department issued grand jury subpoenas to the Fed injected political risk, weakening the U.S. dollar. This perfect storm of easier liquidity and institutional distrust is classic rocket fuel for Bitcoin and its peers.

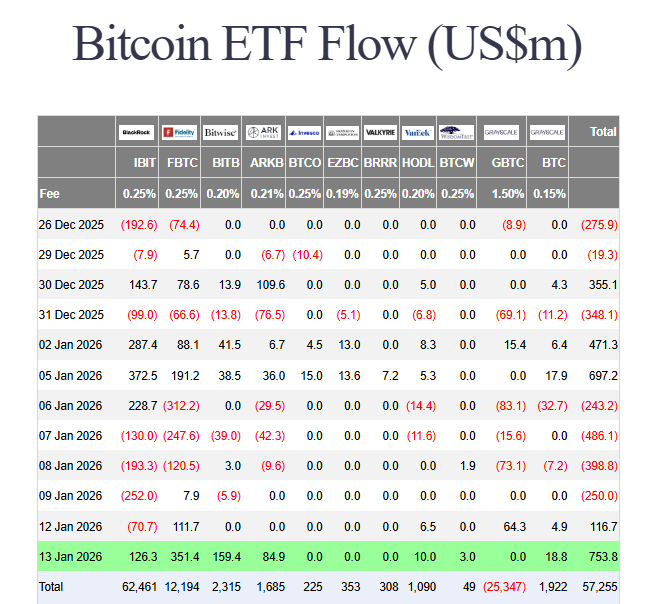

U.S. spot Bitcoin ETFs Have recorded a positive net inflow on January 13 , the highest since October with a staggering $783.8M coming mainly Fidelity , Blackrock and Bitwise. We should highlight that Blackrock have ended a ‘ day streak of net outflows.

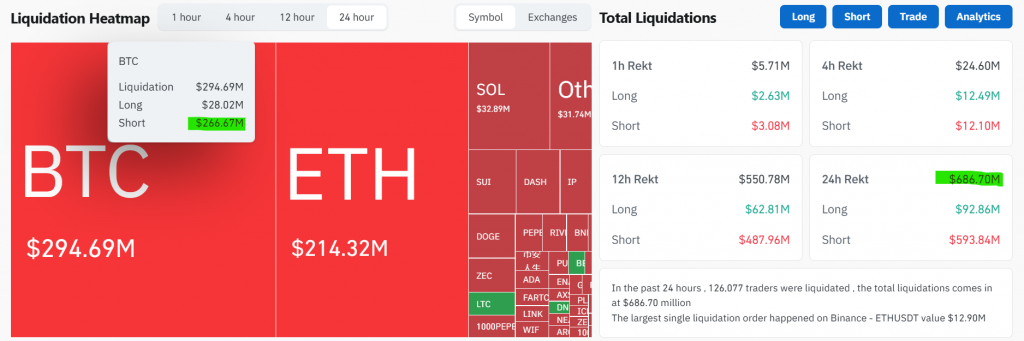

Bears Get Obliterated in the Crypto Market Rally

This move was a nightmare for pessimists. As prices ripped higher, over $686 million in crypto derivatives positions were liquidated in a single day. The vast majority—roughly $593 million—were bearish short bets that got crushed. This massive liquidation event proves traders were heavily positioned for downside, and the swift macro reversal caught them completely off guard.

The rally was echoed in traditional markets, confirming a global risk-on rotation. Asian equities hit record highs, and precious metals like silver surged. This synchronized move shows investors are universally seeking assets that thrive in an environment of looser financial conditions and fiat instability. The crypto market rally isn’t an isolated event; it’s part of a larger capital migration.

My Thoughts

This is the clean, macro-driven breakout we’ve been waiting for. The market has repriced the Fed’s trajectory and is voting with its capital. The scale of the liquidations indicates this rally has real momentum and was fueled by a short squeeze. However, with Bitcoin approaching heavy prior resistance and leverage rebuilding, expect heightened volatility. The key now is for BTC to hold above $94k and transform it into a new support floor. If it does, this crypto market rally could be the launchpad for a full-blown altseason.