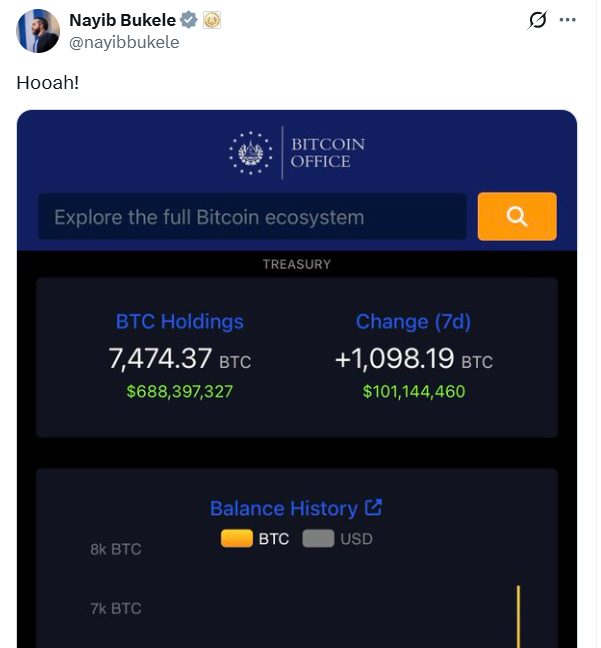

El Salvador Bitcoin Purchase $100M Bitcoin Amid Market Crash

While the crypto market trembles, El Salvador just showcased ultimate conviction with a monumental El Salvador Bitcoin purchase. The nation acquired a staggering 1,090 BTC—worth over $100 million—in a single day, marking its largest buy since adopting Bitcoin as legal tender. This power move boosts its total reserves to 7,474 BTC, valued at approximately $676 million, and signals a fierce commitment to financial sovereignty despite the ongoing price slump.

Record Bitcoin Purchase Defies Market Trends

Amidst widespread fear and selling, El Salvador is aggressively buying the dip. President Nayib Bukele publicly confirmed this record El Salvador Bitcoin purchase, which aligns with the country’s strategy since November 2022 to acquire one Bitcoin daily. Stacy Herbert, Director of the Bitcoin Office, emphasized that these accumulations aim to break free from traditional banking systems and the U.S. dollar’s dominance. Interestingly, this defiance comes despite repeated warnings from the IMF about Bitcoin’s volatility. However, on-chain data proves the government’s consistent buying, and last month, the nation reported $482 million in unrealized profits—a 162% increase since 2022.

Building a Bitcoin-Powered Future

El Salvador isn’t just accumulating BTC; it’s weaving Bitcoin into its national infrastructure. The country has forged partnerships with Pakistan to explore Bitcoin’s role in public projects and is set to host the Bitcoin Histórico conference in San Salvador. Furthermore, it’s digitizing official documents on the Bitcoin blockchain via a collaboration with U.S.-based Simple Proof. CEO Carlos Toriello praised Bitcoin as “the only clock that nobody can manipulate,” highlighting its utility for ensuring data authenticity beyond mere currency use.

My Thoughts

This is alpha behavior on a sovereign level! El Salvador’s relentless accumulation during a downturn screams long-term belief in Bitcoin’s value proposition. While paper hands panic, they’re strategically positioning for a future where BTC underpins financial independence. This could spark a domino effect, encouraging other nations to adopt similar policies and accelerating institutional adoption. For investors, this is a stark reminder: true conviction often shines brightest when markets are darkest.