Ethereum (ETH) has experienced a nearly 10% drop from its recent peak, prompting a significant investor, known as a whale, to seize the opportunity and purchase the dip. This whale withdrew 3,600 ETH, valued at $8.9 million, from Binance.

While the broader cryptocurrency market, including the leading asset Bitcoin, faces challenges in January, certain strategic investors, or whales, are leveraging the market downturn to accumulate digital assets at a discounted rate.

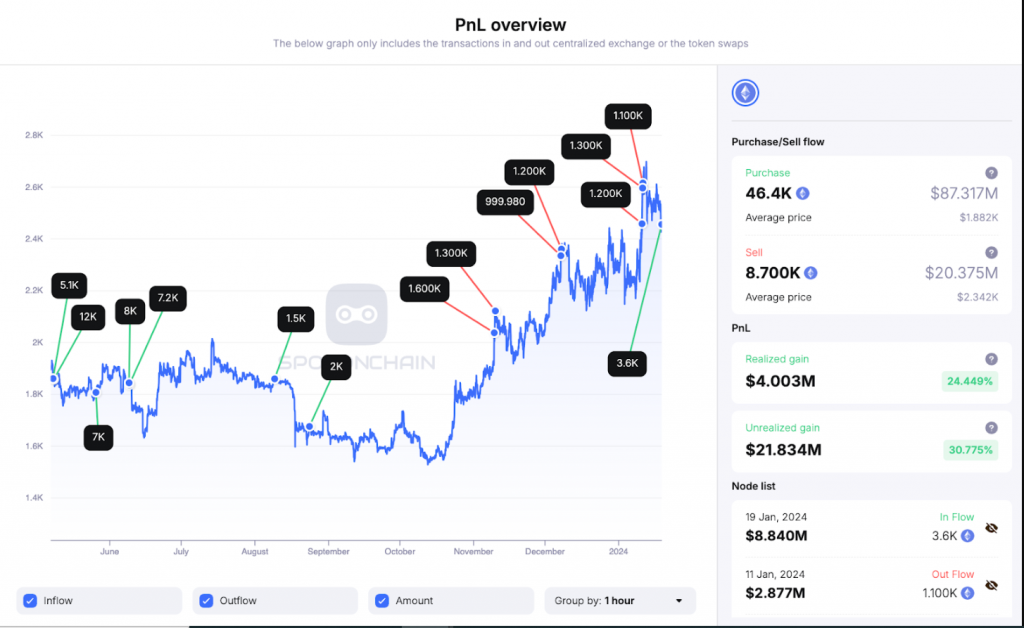

The Ethereum whale in question has re-entered accumulation mode. Last Friday, the wallet address ‘0x347’ withdrew 3,600 ETH from Binance, as revealed by a screenshot from Spotonchain. The historical data indicates that this whale has a pattern of accumulating Ethereum during market lows and selling the asset near its peak.

Notably, this whale had been accumulating Ethereum during the market lows of 2023 before the price began its upward trajectory. According to Spotonchain, they withdrew a substantial 42,800 ETH from Binance, with an average cost of $1,834, between May 8, 2023, and August 24, 2023. Despite the market rally in the last quarter of 2023, the whale distributed their assets. However, on Friday, they resumed buying Ethereum.

The whale currently holds an impressive 31,700 ETH, valued at nearly $78 million. Having already realized profits of $17.25 million, they still have an unrealized profit of $16.403 million.

In the realm of Ethereum, strong staking activities are underway. Despite the setback from the US Securities and Exchange Commission’s (SEC) delay in deciding on Fidelity’s spot Ethereum ETF application, there is heightened interest after the approval of the spot Bitcoin ETF on January 10. Although there has been a slight decline in the smart money wallet’s ETH holdings in the past seven days, according to Nansen analyst Martin Lee, it may not necessarily signify a trend of smart money selling their ETH.

Ethereum staking has reached a new all-time high, with 24% of the total supply staked, indicating a significant attraction for staking activities. Additionally, major Ethereum network upgrades are anticipated in the first quarter of 2024. Recently, the Ethereum core developers deployed the Dencun upgrade on the Goerli testnet, which, when implemented on the mainnet, will facilitate temporary storage and access of off-chain data by Ethereum nodes, aiming to address storage demands.