Cryptocurrency prices have recently broken free from their longstanding positive correlation with luxury watch prices, a connection initially sparked by unprecedented monetary stimulus measures.

While both bitcoin ($BTC) and luxury goods share a common trait—scarcity—their prices were positively correlated until the latter half of 2023, marked by growing optimism around a bitcoin exchange-traded fund (ETF).

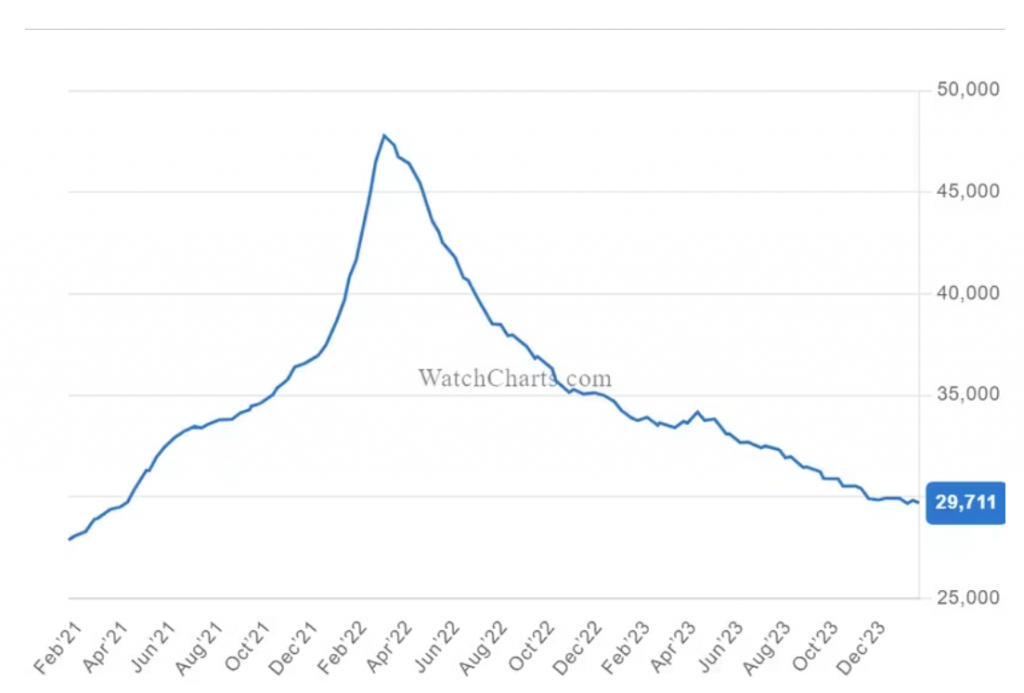

During the Covid years, both crypto and luxury goods experienced a surge in prices due to an influx of easy, cheap money into the economy. However, in the third and fourth quarter of 2023, the paths of luxury watch prices and the CoinDesk 20, a digital asset index, diverged, driven by the anticipation and approval of bitcoin ETFs by the U.S. SEC.

Institutional interest, boosted by the ETF, played a significant role in sustaining bitcoin’s value compared to luxury watches, as observed by Greta Yuan, Head of Research at VDX. Conversely, global monetary tightening impacted luxury watch prices negatively, prompting a decline attributed to tightened monetary policy and reduced speculative trading in luxury assets, as highlighted in a January report by Morgan Stanley analysts.

Despite periodic declines in bitcoin prices, advocates argue for its utility compared to traditional watches, with Nick Ruck, COO of ContentFi Labs, noting the outdated nature of watch utilities in the face of modern technology like smartphones.

Source : Coindesk